Outguessing the Market – Don’t Try It!

Whether picking between funds, working with a fee-only investment advisor in Los Angeles or preparing for an international trip, pricing matters. Active investment management typically involves higher fees and trading costs with a portfolio manager trying to outperform the market. It’s easy to doubt the value of active investment management strategies when considering performance and survivorship of mutual funds. If there was an ability to identify mistakes and exploit mispriced securities, active investment management must be able to outperform their management fee and trading costs to outperform the market.

2. Outguessing the Market – Don’t Try It!

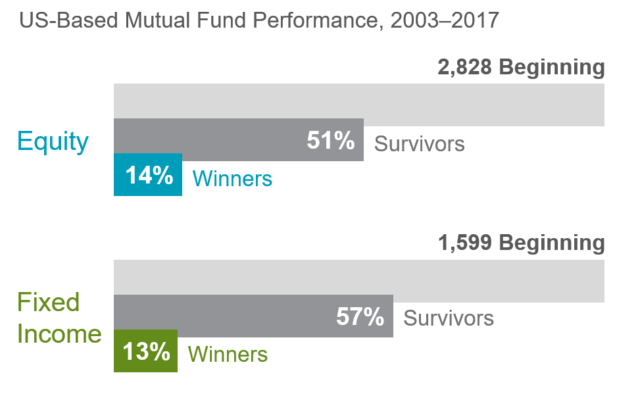

Many fund managers believe they can identify “mispriced” securities and convert that knowledge into higher returns. But fair market pricing works against such efforts, as indicated by the large proportion of mutual funds that have underperformed their Morningstar category index.

In this chart, the gray bars represent the number of US-domiciled equity and fixed income funds in operation during the past 15 years. These funds compose the beginning universe of that period. The dark gray areas show the percentage of equity and fixed income funds that survived the 15-year period. The blue and green bars show the smaller percentage of equity and fixed income funds that survived and outperformed their respective Morningstar category index during the period.

Our research shows that over both short and long time horizons, the deck is stacked against mutual funds that attempt to outguess the market.

This is part two of a ten part series in pursuing a better investment experience.

Part One: Embrace Market Pricing

Part Three: Resist Chasing Past Performance

Part Four: Let Markets Work for You

Part Five: Consider the Drivers of Expected Returns

Part Six: Practice Smart Diversification

Part Seven: Marketing Timing – Avoid It!

Part Eight: Separate Emotions From Investing

Part Nine: Look Beyond Investment Headlines

Part Ten: Control Your Investment Focus

For More:

Learn more about investment management services

What is a fiduciary financial advisor?

The Balance: Warren Buffett’s Advice on Picking Stocks

Fee-Only Investment Advisor Los Angeles

Still have questions in how to pursue a better financial planning and investment experience? Meet with a fee-only investment advisor in Los Angeles or online.

by Brian Fry CFP®

Safe Landing Financial is a Los Angeles, CA fee-only financial advisor providing financial planning, retirement planning and investment management to tech professionals and pre-retirees. When you work with Safe Landing Financial, you work with Brian Fry, a fiduciary and CERTIFIED FINANCIAL PLANNER™ that puts clients’ best interests first. Financial planning services include: retirement planning, charitable giving, asset protection, estate planning, saving for college, debt management, tax strategy and investment management. Safe Landing Financial serves as a virtual fee-only financial advisor to individuals and families nationwide.