8 Things You Need to Know About Fiduciary Financial Advisors

A fiduciary financial advisor puts your best interests first, limits conflicts of interest, and avoids them when possible.

What’s the difference between a fiduciary financial advisor and a traditional financial advisor?

A fiduciary financial advisor limits their conflicts of interest and is required to disclose any potential conflicts of interest. A traditional financial advisor is not incentivized to limit or disclose potential conflicts of interest.

A fiduciary financial advisor must act in your best interest when offering financial advice. A traditional financial advisor is not required to act in your best interest.

A fiduciary financial advisor is obligated to find terms and prices that are best for their clients. A traditional financial advisor may have incentives to earn commissions or sell their own products.

A fiduciary financial advisor offers transparency in providing relevant information and facts to plan your future and manage investments. A traditional financial advisor is only required to make sure investment recommendations are suitable.

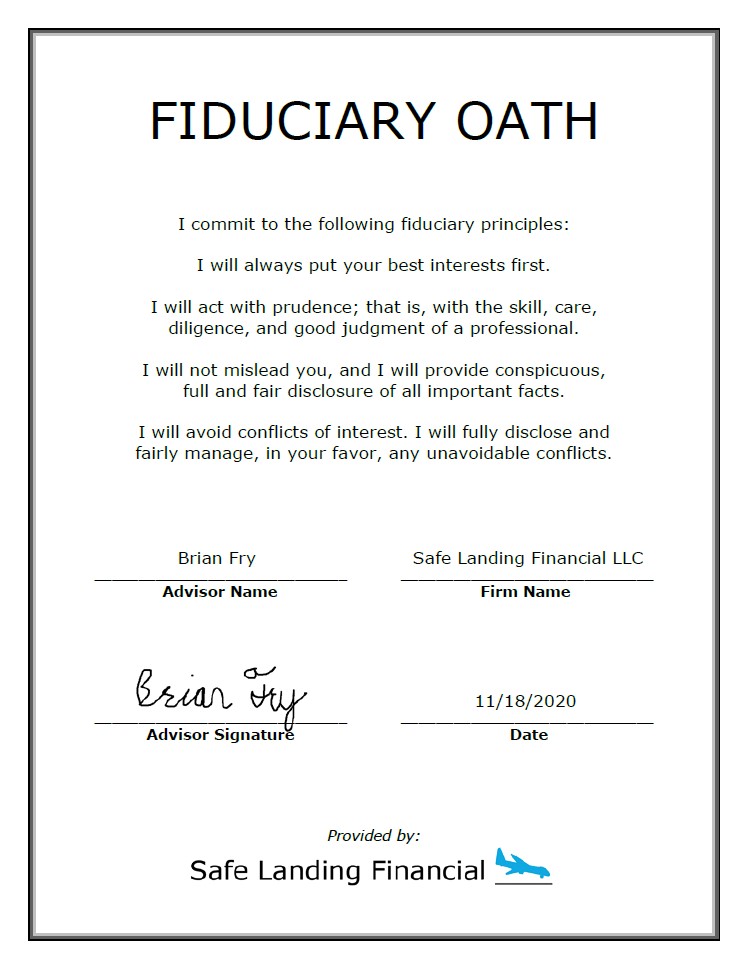

What are fiduciary principles?

A fiduciary financial advisor:

- Manages your financial situation by putting your best interests first.

- Acts with prudence, with the skill, care, diligence, and good judgment of a professional.

- Will not mislead you, and will provide conspicuous, full, and fair disclosure of all essential facts.

- Avoids conflicts of interest when possible. Otherwise, they must fully disclose conflicts of interest and manage them in your favor.

Is my financial advisor a fiduciary?

Here are some questions to help determine if a financial advisor serves in your best interest.

Are you a fiduciary?

Correct: Yes. Follow-up by asking if they will sign a fiduciary oath.

Incorrect: No. Follow-up by asking why they don’t serve clients as a fiduciary.

Do you serve as a fiduciary all the time?

Correct: Yes.

Incorrect: No. Follow-up by asking for them to clarify when they are a fiduciary.

How do you get paid?

Correct: Directly from clients or fee-only.

Incorrect: A complicated fee structure should serve as a red flag. An advisor earning money from commissions may have additional conflicts of interest.

Will you sign a fiduciary oath?

Correct: Yes.

Incorrect: No.

Will your financial advisor sign a fiduciary oath?

Download a fiduciary oath and share it with your advisor to help protect your best interests.

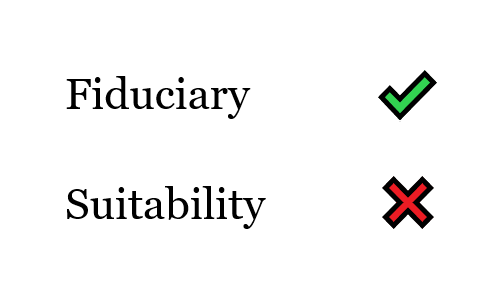

What is the difference between fiduciary and suitability standards?

A financial advisor can be held to one of two standards: fiduciary or suitability.

Fiduciary

A financial advisor held to the fiduciary standard is required to put your interests ahead of their own interests.

Not all financial advisors serve clients under this standard.

Suitability

A financial advisor held to the suitability standard is not required to put your interests ahead of their own interests. To meet suitability requirements, a financial advisor must “check the boxes” for areas making up an investor’s profile, such as:

- the customer’s age

- other investments

- financial situation and needs

- tax status

- investment objectives

- investment experience

- investment time horizon

- liquidity needs

- risk tolerance

Example of fiduciary vs. suitability

A financial advisor must recommend one of two investment options to a client. The two investment options are almost identical and considered suitable investments for the client’s needs. One has a reasonably low-cost while the other charges a higher fee and pays a commission to the financial advisor.

The fiduciary financial advisor would choose the less expensive option. The traditional financial advisor following the suitability standard has more incentive to choose the higher-fee, commission-based investment.

Is a CERTIFIED FINANCIAL PLANNER™ a fiduciary?

The CERTIFIED FINANCIAL PLANNER™ designation is considered the gold standard for financial planning advice. A CERTIFIED FINANCIAL PLANNER™ is held to a higher standard than other financial advisors.

A CERTIFIED FINANCIAL PLANNER™ is required to serve as a “fiduciary at all times” when providing financial advice.

A CERTIFIED FINANCIAL PLANNER™ that works for an independent fee-only Registered Investment Advisor limits conflicts of interest in providing advice.

However, most CFP® Professionals are brokers, meaning they collect commissions and sell products, creating additional conflicts of interest.

While a CERTIFIED FINANCIAL PLANNER™ is required to serve as a fiduciary, consider the importance of limiting additional conflicts of interest when searching for a fiduciary financial planner.

Is a robo-advisor a fiduciary?

A robo-advisor is an online financial advisor that provides automated investment advice with little human interaction. Does a robo-advisor serve clients as a fiduciary?

Many robo-advisors are registered investment advisors, which suggests they have a fiduciary duty to clients. As a registered investment advisor, a robo-advisor is required to act in their clients’ best interests.

However, a robo-advisor is unable to understand the entire situation of an investor. Therefore, a robo-advisor only offers advice on a limited scope.

From an investment standpoint, a robo-advisor can serve as a fiduciary with a limited scope. A robo-advisor cannot offer guidance that a human, a fiduciary financial planner, can provide from a planning standpoint.

How can I find a fiduciary financial advisor?

Here are a few resources to confirm you are working with a fee-only financial advisor.

The National Association of Personal Financial Advisors

“For over 36 years NAPFA has been the standard bearer for fee-only, fiduciary financial advisors advocating for high professional and ethical standards.”

– The National Association of Personal Financial Advisors

Fee-Only Network

“We strive to remove the confusion from topics such as: advisor compensation, fee-only versus fee-based, the fiduciary standard, and the value of working with an advisor.”

XY Planning Network

“Each of our planners uphold (fiduciary) oaths to put your interests and needs first. View signed copies of fiduciary oaths on each advisor profile”

– XY Planning Network

More Resources

Mega-Backdoor Roth Guide + Flowchart

RSU Guide + Strategy After Vesting

Backdoor Roth Guide + Flowchart

HSA Guide for Triple-Tax Advantage

Deferred Compensation Guide

NAPFA: Fiduciary 101

Fee-Only Network: Is My Financial Advisor a Fiduciary

CFP Board: The History of CFP Board’s Fiduciary Standard

FINRA: Suitability Rules

Fiduciary Financial Advisor for Tech Professionals