COMPREHENSIVE FINANCIAL PLANNING SERVICES

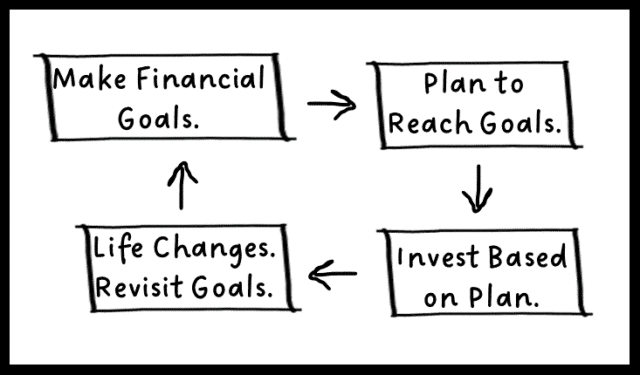

We combine ongoing financial planning with investment management to help you reach your financial destination.

ONGOING FINANCIAL PLANNING

-

- Retirement planning

- Social Security optimization

- Tax planning

- Insurance planning

- Estate planning

- Guidance for stock compensation (ex. RSUs)

- Recommendations for company retirement accounts [ex. 401(k)]

- Recommendations for deferred compensation investments

- Unlimited email and phone support

- Year-round service calendar

INVESTMENT MANAGEMENT

-

- Asset allocation tailored to your goals and risk tolerance

- Globally diversified and tax-efficient portfolios

- Investment strategy based on academic research and empirical evidence

- Portfolio monitoring and periodic rebalancing

- Access to Dimensional funds and direct indexing

- Ability to speak directly with your investment manager

- No minimum asset level required to invest

- On-demand performance reporting

BENEFITS FROM WORKING TOGETHER

-

- Fiduciary financial advice putting your best interests first 100% of the time

- Financial advice without the ulterior motive to sell you products

- No hidden investment fees, including commissions, for product sales or referrals

- Expert guidance to avoid important financial mistakes

- Peace of mind in knowing there is a plan for your financial future

We Specialize In Helping

Personalized comprehensive financial planning for:

Safe Landing Financial Newsletter

Sign up for monthly planning insights for tech professionals and pre-retirees!