2025 Mega-Backdoor Roth Guide: Limits, Benefits & Setup

The 2025 Mega-Backdoor Roth strategy is one of the most powerful ways high earners can boost retirement savings beyond standard 401(k) limits. In this guide, you’ll learn how the strategy works, contribution limits by age, step-by-step setup instructions, tax implications, and when it makes sense to use it.

So if you are looking for answers to questions like…

- What is the mega-backdoor Roth?

- What are step-by-step instructions for how to set up the mega-backdoor Roth?

- When should (or shouldn’t) I use the mega-backdoor Roth strategy?

… then this guide is for you!

This guide is to help you understand the mega-backdoor Roth so you can save more tax-efficiently and minimize taxes in retirement.

How the Mega-Backdoor Roth Works

The mega-backdoor Roth is a strategy for saving more aggressively and tax-efficiently for retirement by making after-tax contributions to a 401(k) plan and then converting those contributions to a Roth IRA or Roth 401(k).

To avoid a future tax headache, it is critical to convert after-tax 401(k) contributions to either a Roth 401(k) or Roth IRA.

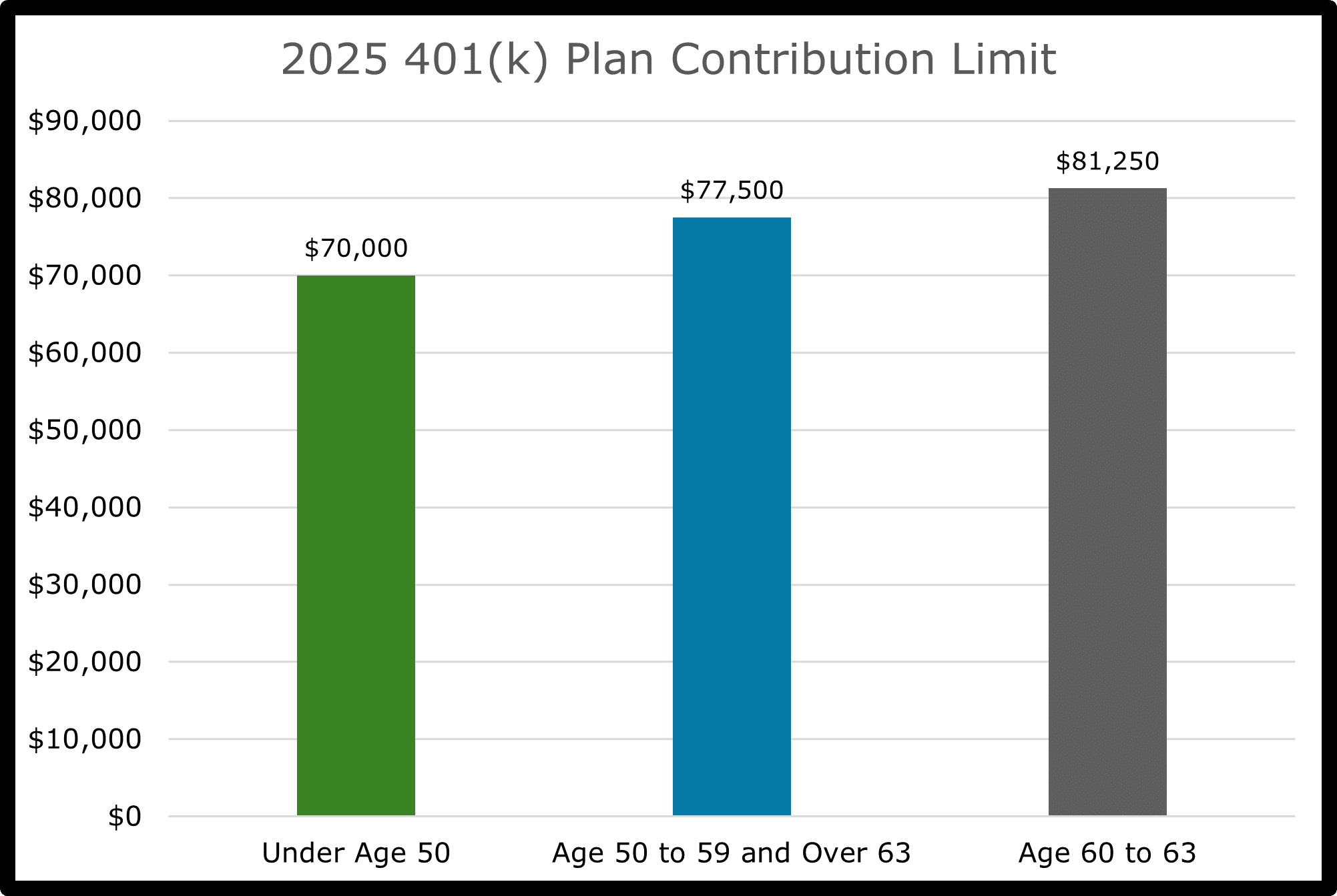

2025 401(k) Contribution Limits by Age

Under Age 50

- Elective deferral: $23,500

- Employer match: It Depends*

- Catch-up contribution: None

- After-tax contribution: It Depends**

- Total limit: $70,000

Age 50 to 59 and Over 63

- Elective deferral: $23,500

- Employer match: It Depends*

- Catch-up contribution: $7,500

- After-tax contribution: ~$40,000**

- Total limit: $77,500

Age 60 to 63

- Elective deferral: $23,500

- Employer match: It Depends*

- Catch-up contribution: $11,250

- After-tax contribution: ~$40,000**

- Total limit: $81,250

* Employer match policies vary by company. Check your 401(k) plan documents or contact your HR or benefits team to confirm match eligibility and limits.

** The amount you can contribute as after-tax contributions depends on your elective deferrals, any employer match, and catch-up contributions. Total 401(k) contributions must stay within the IRS limits for your age group.

How to Find Out if Your Company Offers the Mega-Backdoor Roth

The best way to confirm that your company offers the mega-backdoor Roth is by reviewing your 401(k) plan summary description. The process of reviewing a 30-80 page plan summary description is a bit of a cumbersome task, so if you are unsure, a best practice is to ask your 401(k) plan administrator or financial planner.

Many technology companies offer the mega-backdoor Roth, including: Alphabet (Google), Amazon, Apple, Dell, IBM, Meta (Facebook), Microsoft, Netflix, Oracle, Uber, and Zoom.

For detailed, company-specific guides, see the following:

Here’s a more comprehensive list of companies offering the mega-backdoor Roth.

Step-by-Step Instructions to Set Up the Mega-Backdoor Roth

Step 1: Confirm that your 401(k) plan allows for after-tax contributions.

Step 2: Determine the eligible amount for after-tax contributions.

Step 3: Contact your 401(k)’s plan administrator to set-up in-service conversions or in-service distributions. Ideally, your plan allows for this to take place automatically!

Step 4: Elect for after-tax contributions in your 401(k).

When the Mega-Backdoor Roth Strategy Is (and Isn’t) a Good Fit

When should I consider the mega-backdoor Roth?

- Your 401(k) plan allows after-tax contributions.

- Your 401(k) plan allows in-service conversions to Roth 401(k) or distributions to Roth IRA.

- You maxed out your pre-tax or Roth 401(k) elective deferral and have additional funds to save for retirement.

When should I not consider the mega-backdoor Roth?

- You are not planning to max out your 401(k) elective deferral. However, you may still have the ability to save tax-efficiently with pre-tax and Roth contributions. Additionally, most 401(k) plans only match pre-tax and Roth contributions, not after-tax contributions.

- You have other financial goals than retirement that need more immediate attention for savings.

- If your 401(k) plan does not allow in-service conversions or distributions, then you will need to wait until you leave your job to complete a Roth conversion. Waiting makes this strategy much less effective because after-tax earnings are taxed at ordinary income when converted.

Tax Implications From the Mega-Backdoor Roth Strategy

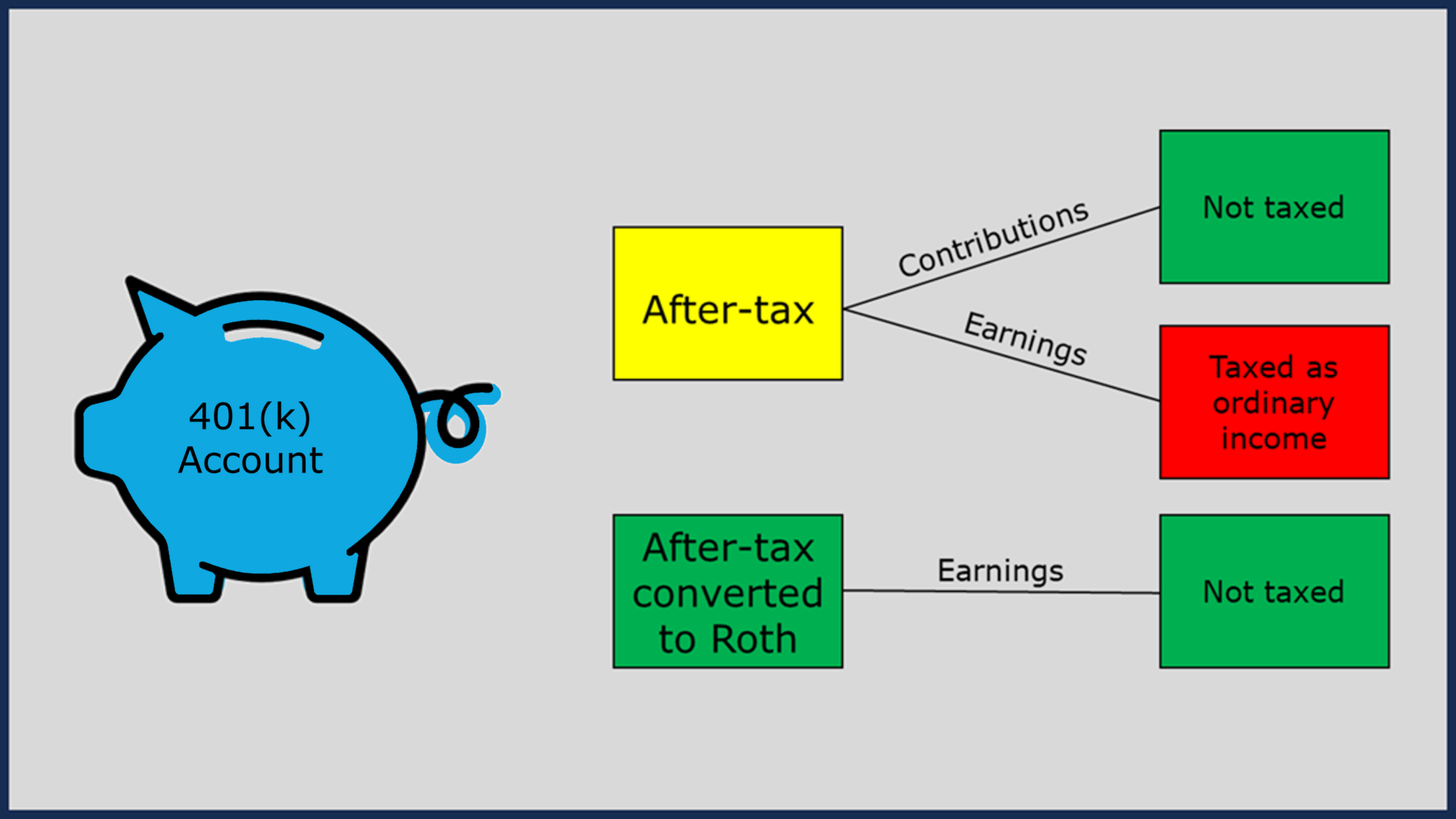

After-tax 401(k) contributions are not taxed when distributed. However, if left untreated, after-tax earnings are taxed as ordinary income when distributed from the 401(k).

So, why would anyone utilize after-tax contributions? After-tax 401(k) contributions grow tax-free after the funds are converted to a Roth IRA or Roth 401(k). Without a Roth conversion, there are generally more tax-efficient ways to save for retirement than by participating in an after-tax 401(k).

Mega-backdoor Roth Case Studies

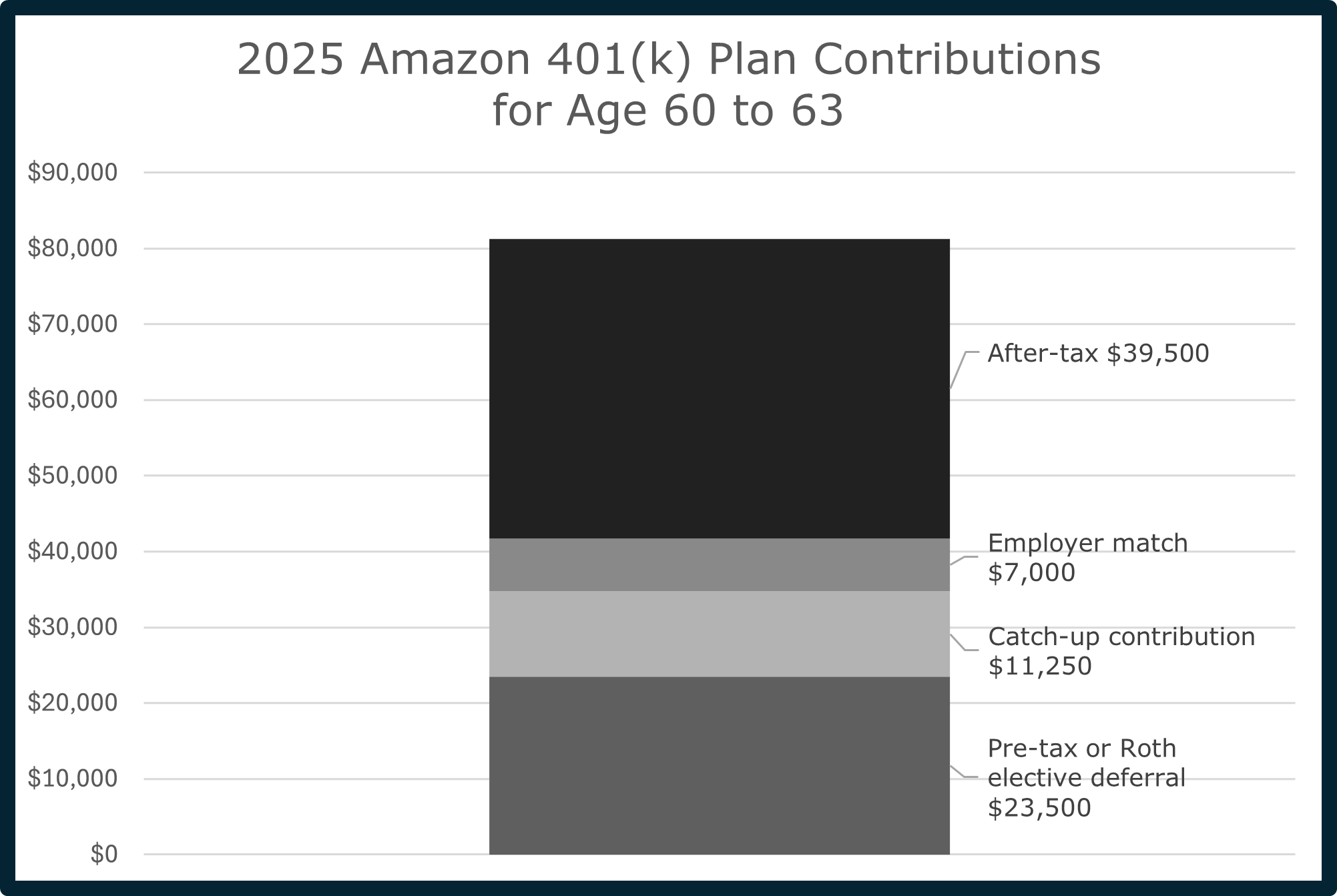

Jeff (60) at Amazon

Jeff is a product manager at Amazon. In 2025, Amazon matches 50% of elective deferrals, up to 4% of eligible pay, with a maximum match of $7,000. Catch-up contributions are not eligible for matching. Jeff earns $500,000 annually and wants to save more for retirement using the mega-backdoor Roth strategy.

- Jeff contributes $23,500 as an elective deferral and an additional $11,250 as a catch-up contribution.*

- Amazon matches $7,000.

- Jeff can contribute an additional $39,500 in after-tax savings toward the mega-backdoor Roth.

*Important Note: The age 60 to 63 catch-up contribution is a new rule for 2025. Please confirm the amount with your 401(k) plan administrator.

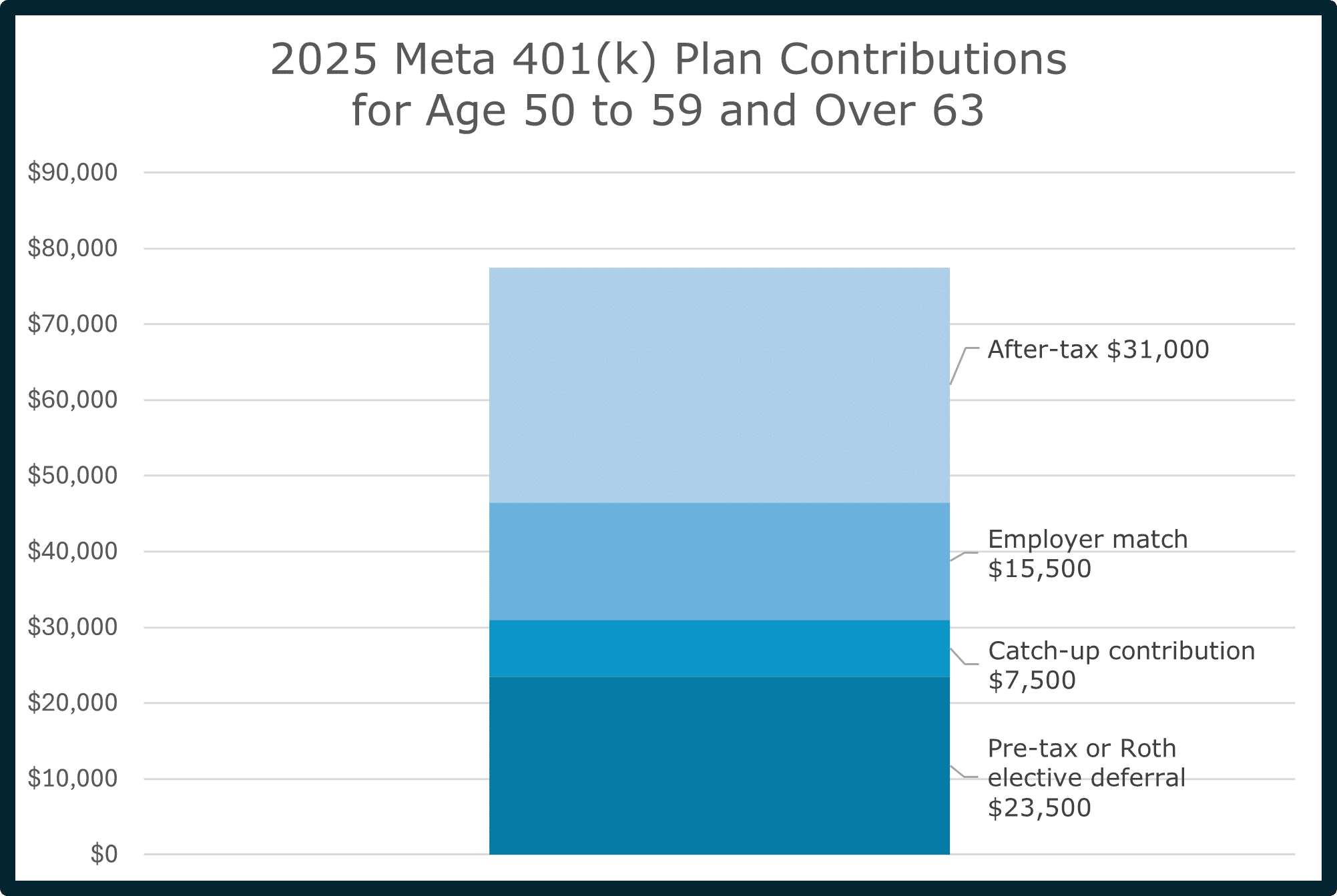

Mark (55) at Meta

Mark is an account executive at Meta. Meta’s 401(k) matches 50% of elective deferrals and catch-up contributions. Mark earns $250,000 annually and wants to save more for retirement using the Mega Backdoor Roth strategy.

- Mark contributes $23,500 as an elective deferral and $7,500 as a catch-up contribution.

- Meta matches $15,500.

- Mark can contribute an additional $31,000 in after-tax savings toward the Mega Backdoor Roth.

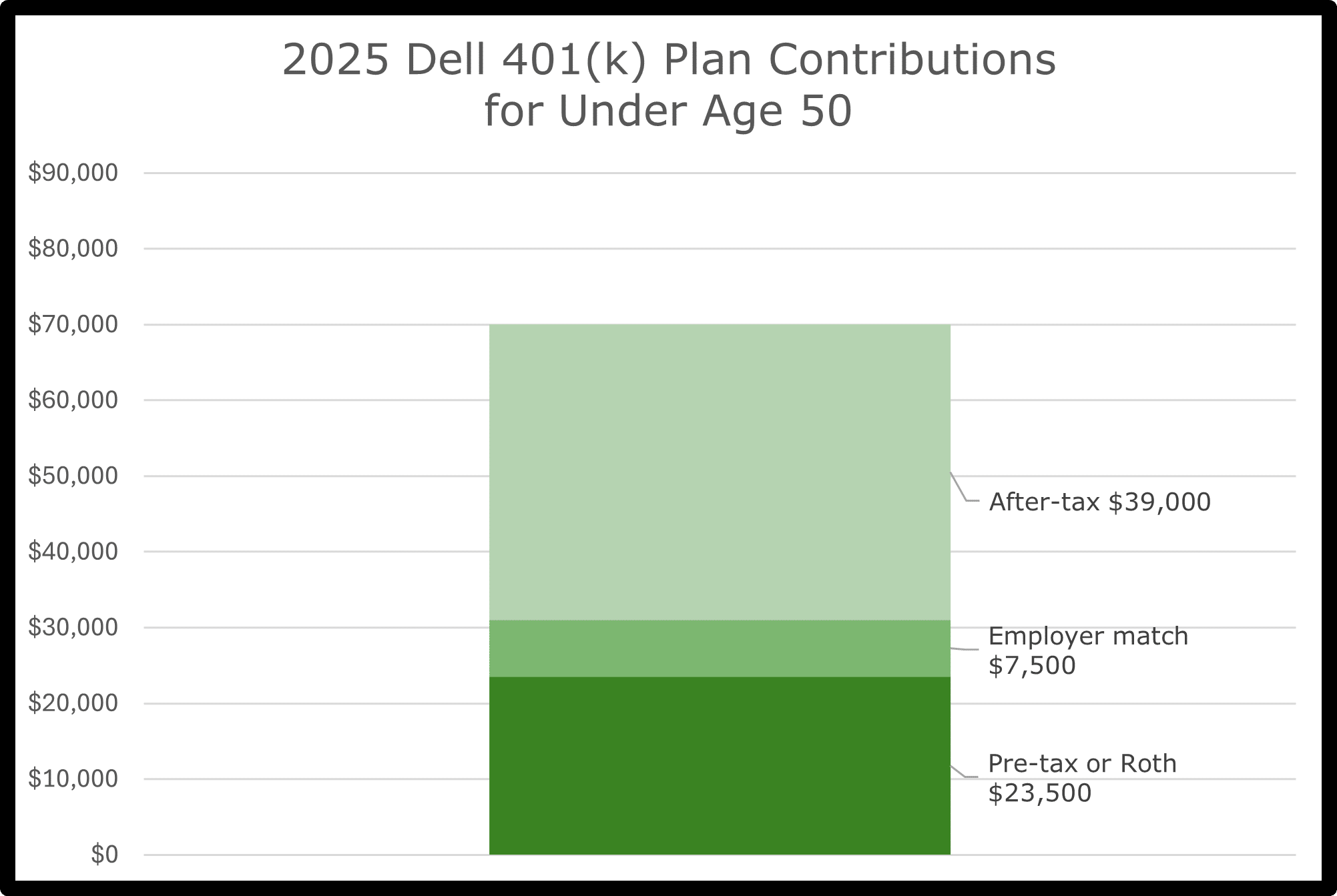

Kelly (48) at Dell

Kelly is a senior director at Dell. Dell’s 401(k) matches 100% of contributions, up to 6% of eligible pay, with a maximum match of $7,500. Kelly earns $300,000 annually and wants to save more for retirement using the Mega Backdoor Roth strategy.

- Kelly contributes $23,500 as an elective deferral.

- Dell matches $7,500.

- Kelly can contribute an additional $39,000 in after-tax savings toward the Mega Backdoor Roth.

FREE FINANCIAL PLANNING CONSULTATION

A complimentary 4-step process sharing how to minimize

taxes, optimize investments, and enjoy retirement on your terms.

This process is designed to help you evaluate our services

and make an informed choice for planning your financial future.

Mega-Backdoor Roth FAQs

1. Can I contribute to a traditional or Roth IRA in addition to the mega-backdoor Roth?

Yes. You can contribute to a traditional or Roth IRA in addition to the 401(k) and mega-backdoor Roth, as long as you stay within IRS limits.

If your income is too high to contribute directly to a Roth IRA, then you can use the backdoor Roth strategy alongside the mega-backdoor Roth to maximize your tax-free retirement savings.

2. What’s the backdoor Roth, and can I do both the backdoor Roth and mega-backdoor Roth strategies?

The backdoor Roth IRA is a strategy for high-income earners who exceed the IRS income limits for direct Roth IRA contributions. It involves making a non-deductible contribution to a traditional IRA and then converting those funds to a Roth IRA.

In 2025, the IRA contribution limit is $7,000 for individuals under age 50 and $8,000 for those age 50 or older.

Yes, individuals can use both strategies. The backdoor Roth is done through your personal IRA, while the mega-backdoor Roth is done through your 401(k) using after-tax contributions.

Combining both allows you to maximize tax-free retirement savings beyond standard limits.

Learn more about the backdoor Roth IRA strategy

3. What is the maximum mega-backdoor Roth contribution for 2025?

The total 401(k) contribution limit in 2025 depends on your age:

- $70,000 for employees under age 50

- $77,500 for employees age 50 to 59 and over 63

- $81,250 for employees age 60 to 63

4. Does my employer match my after-tax 401(k) contributions?

Employers generally do not match after-tax 401(k) contributions used for the Mega-Backdoor Roth strategy.

After-tax contributions are voluntary contributions made beyond the elective deferral limits. Employers are not required or incentivized to match them. The IRS doesn’t prohibit matching after-tax contributions, but it’s extremely rare and almost never included.

5. How often should I convert my after-tax 401(k) contributions to Roth?

To minimize taxable earnings, it’s best to convert after-tax contributions frequently, ideally after every paycheck or on a monthly schedule.

- If converting to Roth 401(k): Check to see if your 401(k) plan allows an automatic in-plan Roth conversion feature.

- If converting to a Roth IRA: You must manually initiate the conversion each time after the after-tax contribution posts.

6. How are earnings taxed for after-tax 401(k) contributions if I don’t convert?

If you don’t convert after-tax contributions to a Roth account, any earnings will grow and be taxed as ordinary income when withdrawn. Converting promptly allows those earnings to grow tax-free in a Roth account.

7. Can I withdraw money from my mega-backdoor Roth anytime?

While converted Roth contributions can typically be withdrawn tax-free, earnings must remain invested for at least five years and until age 59.5 to avoid taxes and penalties. This strategy is best used for long-term retirement savings.

8. If I leave my employer, can I still make mega-backdoor Roth contributions?

No. You can’t make new after-tax contributions to your old employer’s 401(k) plan after leaving the company. However, you may be able to continue the strategy at a new employer if their 401(k) plan supports it.

9. Is the mega-backdoor Roth strategy worth it for high-income earners?

Yes. For high-income earners who max out their pre-tax or Roth 401(k) and want to save more for retirement, the mega-backdoor Roth is one of the most powerful strategies available. It allows for substantial tax-free growth that is otherwise unavailable to high-income earners.

10. When Should I Consider Using a Mega-Backdoor Roth Instead of Saving in a Taxable Account?

The mega-backdoor Roth is generally a better option when:

- You’re saving for long-term retirement, not short-term goals like buying a home or funding college.

- You’ve already maxed out your standard 401(k) elective deferrals.

- You want your investments to grow tax-free, rather than paying taxes annually on interest, dividends, or capital gains in a taxable account.

- You’re looking to build tax diversification for retirement — having a mix of pre-tax, Roth, and taxable assets gives you more flexibility when withdrawing funds in the future.

11. What are the risks of the mega-backdoor Roth strategy?

- Missing the conversion step may result in taxable earnings.

- After-tax contributions are not generally matched.

- Retirement funds are not easily accessible before retirement.

- The process for setting up the mega-backdoor Roth can be confusing and there are time-sensitive components to the conversion.

Working with a fiduciary financial planner can help ensure the strategy is executed correctly.

More Resources

Can I Make a Mega-Backdoor Roth Contribution? (Free PDF resource)

2025 Important Planning Numbers? (Free PDF resource)

Backdoor Roth Guide + Flowchart

RSU Guide + Strategy After Vesting

Deferred Compensation Guide + Case Study

HSA Guide + Strategy for Reimbursement

Investopedia Roth 401(k) vs. Roth IRA: What’s the Difference?

Business Insider Backdoor Roth IRA: Understanding the loophole that gives high-income earners the tax benefits of a Roth IRA

Safe Landing Financial Newsletter

Sign up for monthly planning insights for tech professionals and pre-retirees!