Backdoor Roth Strategy Guide (2024 Update)

The Roth IRA is one of the premier account choices when saving tax-efficiently for retirement. However, it remains out of reach for some savers due to high-income restrictions.

The backdoor Roth IRA strategy provides a solution for many to overcome this obstacle.

So if you want answers to questions like…

- What is the backdoor Roth strategy?

- What are the steps for executing the backdoor Roth strategy?

- What if I don’t qualify for the backdoor Roth strategy?

… then this guide is for you!

How the Backdoor Roth Works

What is the backdoor Roth strategy?

The backdoor Roth strategy enables savers whose income exceeds certain thresholds to still fund a Roth IRA through a workaround process.

Who is the backdoor Roth strategy for?

The backdoor Roth strategy caters exclusively for high-income individuals and households seeking to save tax-efficiently for retirement.

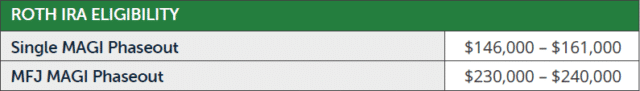

In 2024, Roth IRA phase-outs occur from $146,000 to $161,000 of modified adjusted gross income (MAGI) for single filers and between $230,000 and $240,000 of MAGI for married filing jointly filers.

Source: 2024 Important Planning Numbers

Steps for Executing the Backdoor Roth IRA Strategy

Step 1: Confirm that your income is above the Roth IRA thresholds.

If your MAGI falls below $146,000 for single filers or $230,000 for married filing jointly filers, then you can contribute directly to a Roth IRA, eliminating the need for the backdoor Roth strategy.

Step 2: Verify that you have no pre-tax IRA funds.

Before attempting the Backdoor Roth strategy, ensure you have no pre-tax IRA money funds lingering in any traditional IRAs, rollover IRAs, SEP IRAs, and SIMPLE IRAs.

Step 3: Open traditional and Roth IRA accounts.

If not already established, open both a traditional IRA and a Roth IRA.

Step 4: Make non-deductible IRA contribution.

Contribute to your traditional IRA.

Step 5: Wait. Then, convert IRA funds to Roth IRA.

Allow time to pass for IRA funds to settle before making the Roth conversion. Then, convert non-deductible IRA funds to your Roth IRA.

Backdoor Roth IRA FAQs

What are the tax benefits from saving with the backdoor Roth IRA strategy?

- The backdoor Roth strategy allows high-earning savers the opportunity to save tax-efficiently for retirement that otherwise wouldn’t be able to outside of a company retirement plan.

- Roth IRA investments grow tax-free.

- Distributions are tax-free after waiting five years and reaching age 59.5.

- Roth IRAs have no required minimum distributions.

What if I have other pre-tax IRA money?

Start by determining if there might be other advanced planning strategies that aren’t maxed out that allow you to save tax-efficiently. Consider consulting with a financial planner to determine your savings order.

It’s crucial to consider all pre-tax IRA funds, such as Rollover IRAs, Traditional IRAs, SIMPLE IRAs, or SEP IRAs, as they might complicate the process to fund the backdoor Roth strategy.

There are a few ways to become eligible for the backdoor Roth strategy if you already have pre-tax IRA funds.

- Your employer’s retirement plan may allow a reverse rollover. By zeroing out your pre-tax IRA funds, you become eligible to participate in the backdoor Roth strategy.

- You may have a smaller pre-tax IRA amount and prefer to convert this portion to Roth IRA to become eligible for the backdoor Roth strategy. You are taxed at ordinary income tax rates for Roth conversions with pre-tax funds. If you have a larger pre-tax IRA and are a high-income earner, then it’s not likely advantageous to consider Roth conversions to become eligible for the backdoor Roth strategy.

Can I do the backdoor Roth strategy multiple times in one year?

Yes, you can perform the backdoor Roth IRA strategy as many times as you wish within a year as long as you stay within the annual IRA contribution limits. Retirement savers under 50 can contribute up to $7,000 to an IRA in 2024. Retirement savers 50 and older can contribute an additional $1,000 catch-up contribution to an IRA.

When is the backdoor Roth strategy not a good fit?

The backdoor Roth strategy might not be a good fit if:

- You haven’t already maxed out other tax-advantaged opportunities that may be ahead for your savings order such as a health savings account.

- You aren’t a high-income earner and qualify to contribute directly to a Roth IRA.

- You don’t have an adequate emergency fund in place.

- You have high interest debt.

- You have a pre-tax IRA balance and…

- Your employer’s retirement plan doesn’t allow reverse rollovers.

- Your employer’s retirement plan has high costs.

- You aren’t already maxing out your employer’s retirement plan and other advanced planning opportunities.

- You don’t have the extra cash to pay for the Roth conversions needed to qualify for the backdoor Roth strategy.

What do I need to file for taxes when implementing the backdoor Roth strategy?

Form 8606 must be filed with your tax return for any year in which you make non-deductible contributions to a traditional IRA or convert IRA funds to a Roth IRA.

Form 8606 is used to ensure accurate tax reporting and help prevent double taxation. It’s essential to complete this Form 8606 accurately and include it with your tax return to avoid potential tax penalties.

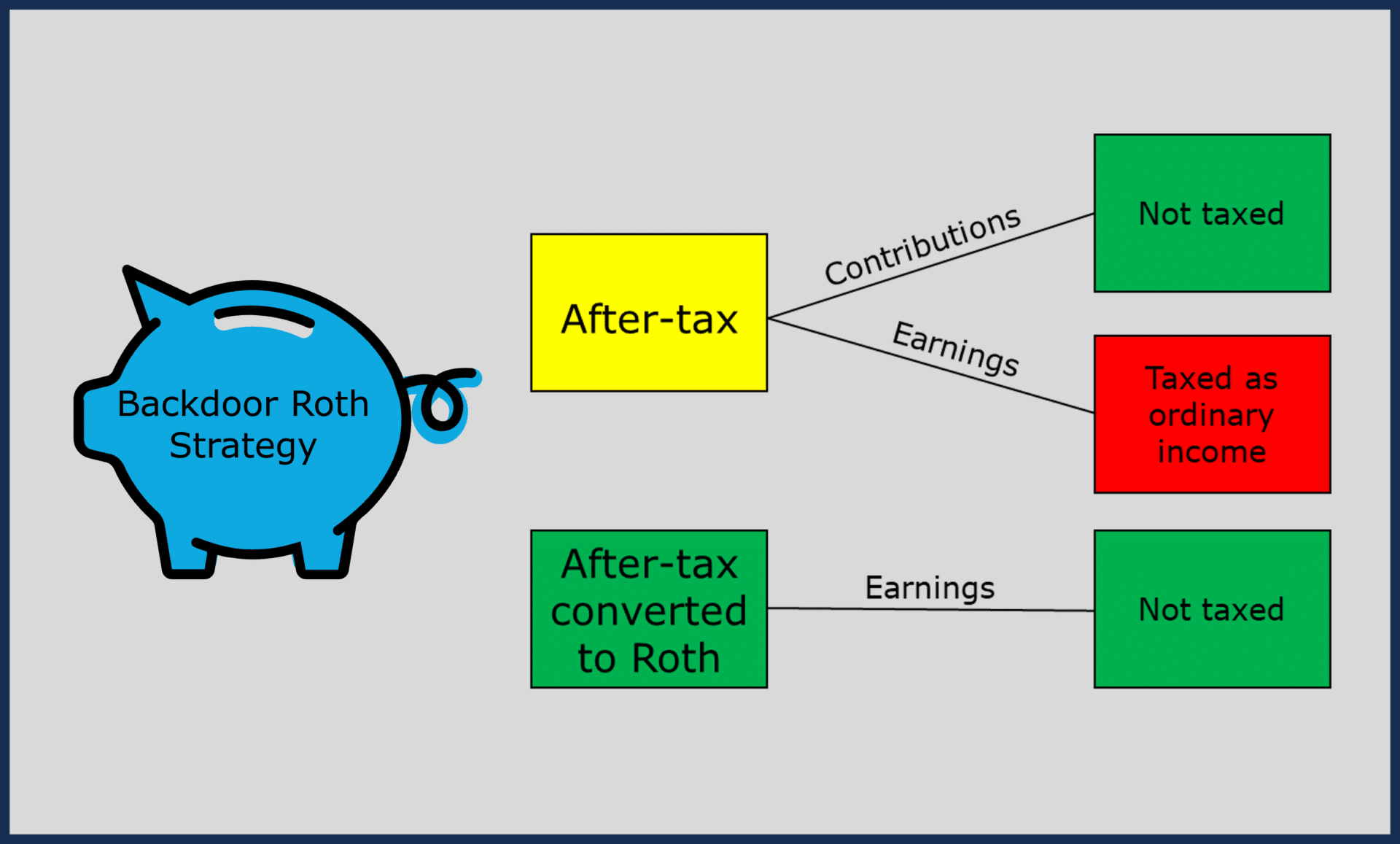

How is the mega-backdoor Roth different from the backdoor Roth strategy?

The backdoor Roth and mega-backdoor Roth are both advanced planning strategies used to contribute funds to a Roth account. While similar in name, they differ in terms of contribution limits, eligibility, and implementation.

Process

The mega-backdoor Roth strategy entails making after-tax 401(k) contributions and then converting funds to Roth IRA or Roth 401(k).

Contribution Limits

The contribution limits are significantly higher for the mega-backdoor Roth strategy. The mega-backdoor Roth contribution limit depends on your 401(k) plan’s employer match. It’s best found by taking the total 401(k) contribution limit and subtracting out the pre-tax or Roth elective deferral contribution limit and employer match.

Eligibility

For eligibility, your employer’s 401(k) plan must allow after-tax 401(k) contributions beyond the pre-tax and Roth elective deferral limit and the ability to make Roth conversions.

Example

For example: Ron Rock, age 48, is a director of product management at Dell. For 2024, Ron can contribute $23,000 to pre-tax or Roth. Dell matches 6% of contributions up to $7,500. Dell’s 401(k) plan allows after-tax contributions and the ability to make Roth conversions. Ron is eligible to make $38,500 in after-tax contributions to the Dell 401(k) plan to convert to Roth IRA or Roth 401(k).

Summarizing backdoor Roth vs. mega-backdoor Roth

While both strategies involve workaround processes to move funds to Roth accounts, the mega-backdoor Roth typically allows for higher contribution limits and requires eligibility based on the features of your employer’s 401(k) plan. Meanwhile, the backdoor Roth has lower contribution limits and is generally available to anyone with earned income.

Best Practices for the Backdoor Roth Strategy

Consider pro-rata rules.

It’s critical to ensure you have no pre-tax IRA funds prior to attempting the backdoor Roth strategy. Otherwise, you are subject to pro-rata rules, creating a future tax headache for your CPA and you because the IRS treats all IRA funds as one combined balance regardless of if it’s all in the same account. With the pro-rata rule, a portion of your Roth conversion is taxed, and a portion of the remaining IRA balance will be after-tax.

Consider the step-doctrine.

The step-doctrine is a term for showing multiple steps as part of the backdoor Roth strategy instead of instantly converting funds to Roth IRA. There is no IRS-confirmed time-period for how long one needs to wait before converting funds from IRA to Roth IRA. Some financial advisors wait one year while others may wait less. Others argue if there even a need to wait at all. Be mindful when determining the right amount of time that you are comfortable with.

Investing during the waiting period.

It’s tempting to start investing the IRA right away during the waiting period. But keep in mind, any growth of IRA funds is taxed once converted to Roth IRA.

FREE FINANCIAL PLANNING CONSULTATION

A complimentary 4-step process sharing how to minimize

taxes, optimize investments, and enjoy retirement on your terms.

This process is designed to help you evaluate our services

and make an informed choice for planning your financial future.

More Resources

Can I Do a Backdoor Roth Contribution? (Free flowchart PDF)

Mega-Backdoor Roth Guide + Flowchart

RSU Guide + Strategy After Vesting

Deferred Compensation Guide + Case Study

HSA Guide + Strategy for Reimbursement

TurboTax Roth 401(k) vs. Roth IRA: What’s the Difference?

Safe Landing Financial Newsletter

Sign up for monthly planning insights for tech professionals and pre-retirees!