RSU Guide + Strategy After Vesting (2025 Update)

Restricted stock units (RSUs) are a type of stock compensation for technology and other high-earning professionals, often representing a large percentage of take-home pay.

So if you want answers to questions like…

- What are key terms for RSUs?

- What are the tax consequences for RSUs?

- What should I do with RSUs after vesting?

… then this guide is for you!

Key terms for restricted stock units

Instead of giving away shares of stock, a company promises to give an employee a portion of stock gradually over a period of time.

RSUs are used to help incentivize employees to stay with and grow with a company long-term.

Depending on the performance of the company, RSUs can fluctuate in value.

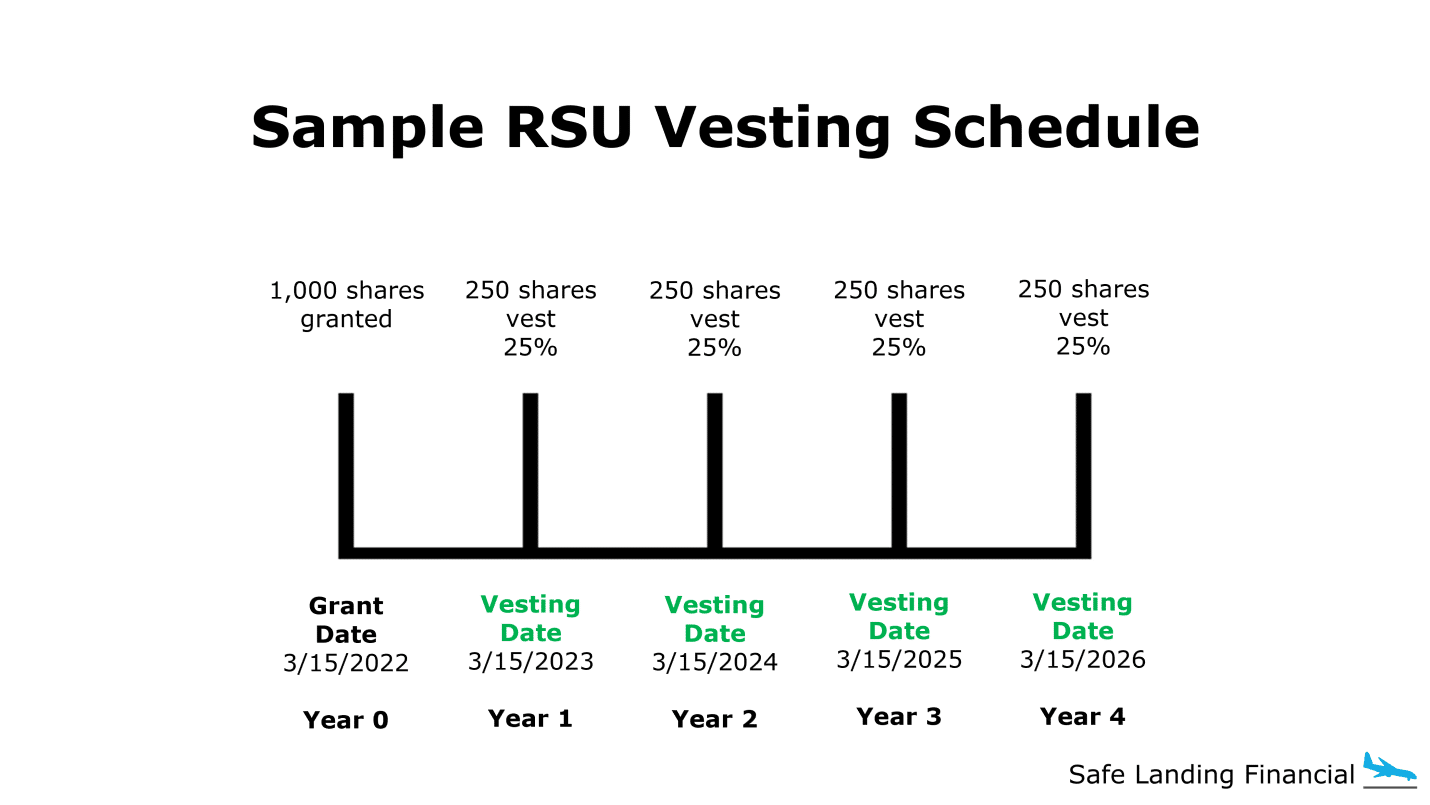

Some important terms for RSUs are the grant date, vesting schedule, and vesting date.

RSU Grant

An RSU grant is a promise your company makes to give a number of shares in the future based on a vesting schedule.

RSU Vesting

RSU vesting is when you officially become the owner of the granted shares of stock.

RSU Grant Date

The grant date is the day your company promises to give a number of shares in the future based on a vesting schedule.

RSU Vesting Schedule

The vesting schedule is usually time-based and can also include performance metrics. Vesting schedules are usually graded, meaning a percentage of granted shares vest on specific days.

RSU Vesting Date

The vesting date is the day that you officially become the owner of the granted shares of stock.

Some events may cause granted shares to not reach the vesting date. Leaving a job early almost always stops vesting. When offering RSUs, a company shares a policy for how they treat RSU grants for retirement, disability, and death.

RSU Dividend and Voting Rights

RSUs don’t receive dividend or voting rights until the shares vest.

How are restricted stock units taxed?

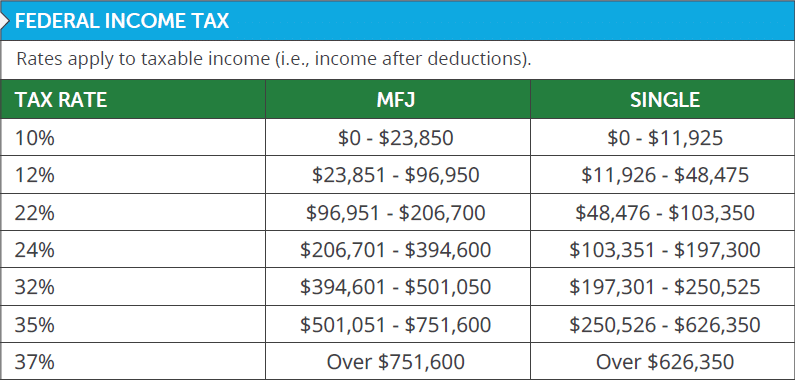

RSUs have two tax triggers. Vesting causes ordinary income tax. Selling shares causes capital gains tax.

Vesting RSUs = Ordinary Income Tax

When shares vest, you’ll owe taxes for:

- Federal

- Social Security

- Medicare

- State

- Local

Many companies automatically sell 22% of RSUs at vesting to provide automatic tax withholding or may offer the option to adjust withholding.

Source: 2025 Important Planning Numbers

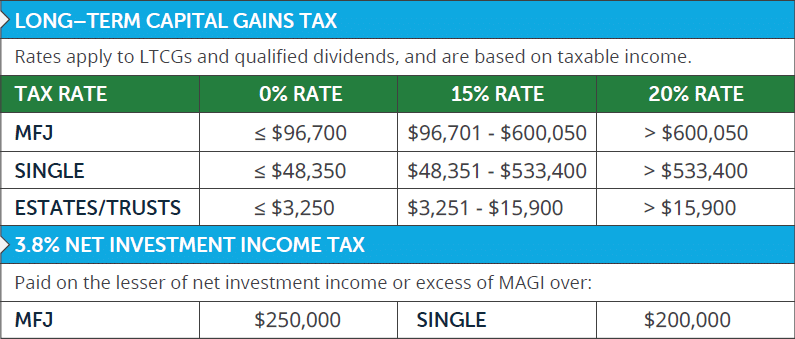

Selling RSUs = Capital Gains Tax

If your company enjoys high growth between the grant and vesting date, RSUs may cause a higher-than-expected tax bill.

If you sell shares right at vesting, then there are no taxable consequences for capital gains.

Selling after vesting causes taxable consequences for recognizing capital gains.

If held for under one year, selling vested RSUs causes a short-term capital gain which is taxed at your highest marginal tax rate.

If held for over one year, selling vested RSUs causes a long-term capital gain, which is generally taxed at 15% or 20% based on your income level.

If you’re receiving RSUs, then it’s important to be aware of the net investment income tax (NIIT) when selling RSUs. NIIT is an additional 3.8% tax for capital gains on modified adjusted gross income above $250,000 for married filing jointly or $200,000 for individuals.

Source: 2025 Important Planning Numbers

Should I sell or keep RSUs after vesting?

Your RSUs have vested… now what? Should you sell or hold the stock?

It depends.

How do the RSUs play into your long-term financial plan?

Consider the impact of a concentrated stock position within your portfolio.

Generally, I recommend having at least 95% of your total investments in a globally diversified portfolio based on your unique financial situation.

For those that enjoy picking investments outside of the strategic globally diversified portfolio, I have no problem with choosing 5% of one’s total investments. I call this portion of a overall portfolio as a “play account.”

I don’t recommend trading individual stocks if you don’t have the time, interest, discipline, and expertise for researching and managing a portfolio.

If you want to manage investments for the play account, would you rather hold your RSUs OR pick other investments such as stocks or cryptocurrency?

This is why, unless you have a strong opinion towards keeping the stock, it makes sense to sell RSUs at vesting. Remember, RSUs are just another form of income.

Why put your hard-earned dollars in one company?

What happens to your financial situation if your company goes bankrupt? Do you want one company controlling your income, benefits, 401(k) contributions and company match, and investments?

There are no additional incentives to keep the RSUs past vesting unless you believe the company is going to outperform the rest of the stock market. A diversified portfolio is much safer for planning your financial future.

More Resources

What Issues Should I Consider Regarding My Restricted Stock Units? (Free PDF resource)

2025 Important Planning Numbers? (Free PDF resource)

Mega-Backdoor Roth Guide

Backdoor Roth Guide

Deferred Compensation Guide + Case Study

HSA Guide + Strategy for Reimbursement

Guide for RSUs at Dell

Forbes 5 Big Mistakes To Avoid With Stock Options And Restricted Stock Units

Safe Landing Financial Newsletter

Sign up for monthly planning insights for tech professionals and pre-retirees!