Deferred Compensation Guide (2025 Update)

Non-qualified deferred compensation (otherwise referred to as deferred compensation or NQDC in this article) is an employee benefit available for some high-earning tech professionals planning their financial future.

So if you are looking for answers to questions like…

- What is a deferred compensation plan?

- Should I participate in my employer’s deferred compensation plan?

- What are the risks of deferred compensation?

… then this guide is for you!

What is a deferred compensation plan?

A deferred compensation plan is offered as a company benefit giving individuals the opportunity to defer a percentage of base pay, commissions, and bonuses to a later date to better align with retirement or other financial goals.

NQDC stays “unfunded”, meaning that an individual participant does not retain their rights to any specific assets until distribution.

Deferred amounts are held in an account with investment options similar to what one mind find in a 401(k) plan. While the individual may not retain their rights, the individual gets to choose how their investments are allocated.

NQDC allows individuals to receive tax benefits. FICA tax is paid when income is earned. Meanwhile, federal tax, state tax, and local tax is deferred until the deferred compensation plan distributes proceeds.

The plan is written. Plan documents specify a timing schedule and how frequently one is paid. An individual generally makes an election to defer compensation during open enrollment for the following year’s income.

A timing schedule may give an individual the option to receive distributions over one lump-sum or spread over multiple installments (ex. over 10 to 15 years). In many cases, an individual has the option to select a year in the future for distributions. Beware, some deferred compensation plans begin distributions with a job separation prior to the desired distribution serving as the triggering event.

Should I participate in my employer’s deferred compensation plan?

It depends. Like most financial questions, there is no 100% correct answer to participating in your plan’s nonqualified deferred compensation plan. Here are a few questions to help in answering if you should participate.

Is there a current year tax benefit?

Deferred compensation is a tool that can help you get below the a certain tax bracket if used properly.

Are you expecting your taxes to be higher, the same, or lower in the future?

It’s difficult to project future tax projections because the current tax rules are set to sunset in 2025. No one knows what future taxes are going to look like. That’s why it’s best to analyze projections based on assumptions on an annual basis.

A good financial advisor or CPA can help you run tax planning projections to share if your taxes will be higher, the same, or lower in the future. But keep in mind, that’s all they are… projections.

Are you prioritizing the right accounts first before considering deferred compensation? Including the following account types: 401(k), HSA, IRA, 529 plan, and taxable brokerage?

While it depends on one’s unique financial situation, contributing to and investing in nearly all account types should generally be considered before a nonqualified deferred compensation plan.

Can you afford to take the risk if you never receive distributions?

Nonqualified deferred compensation remains unfunded, meaning that there is no creditor protection for an individual.

In the event of the company’s bankruptcy, the right of an individual to receive deferred amounts are the same as all other unsecured creditors.

If you never see this money again, how would it impact your financial plan? Alright, now we can step away from the ledge. How much trust do you have in your employer? What percentage of your investment portfolio’s overall risk is in the deferred compensation plan?

As a general rule of thumb, some financial planners suggest not holding more than 5% to 10% of total investments within a nonqualified deferred compensation plan.

I strongly suggest determining your comfort level and the optimal amount for your unique financial situation.

Are you close to low-income, gap, or retirement years?

While it depends on one’s unique situation, low-income, gap, and retirement years generally allow for good opportunities to recognize distributions from NQDC plans.

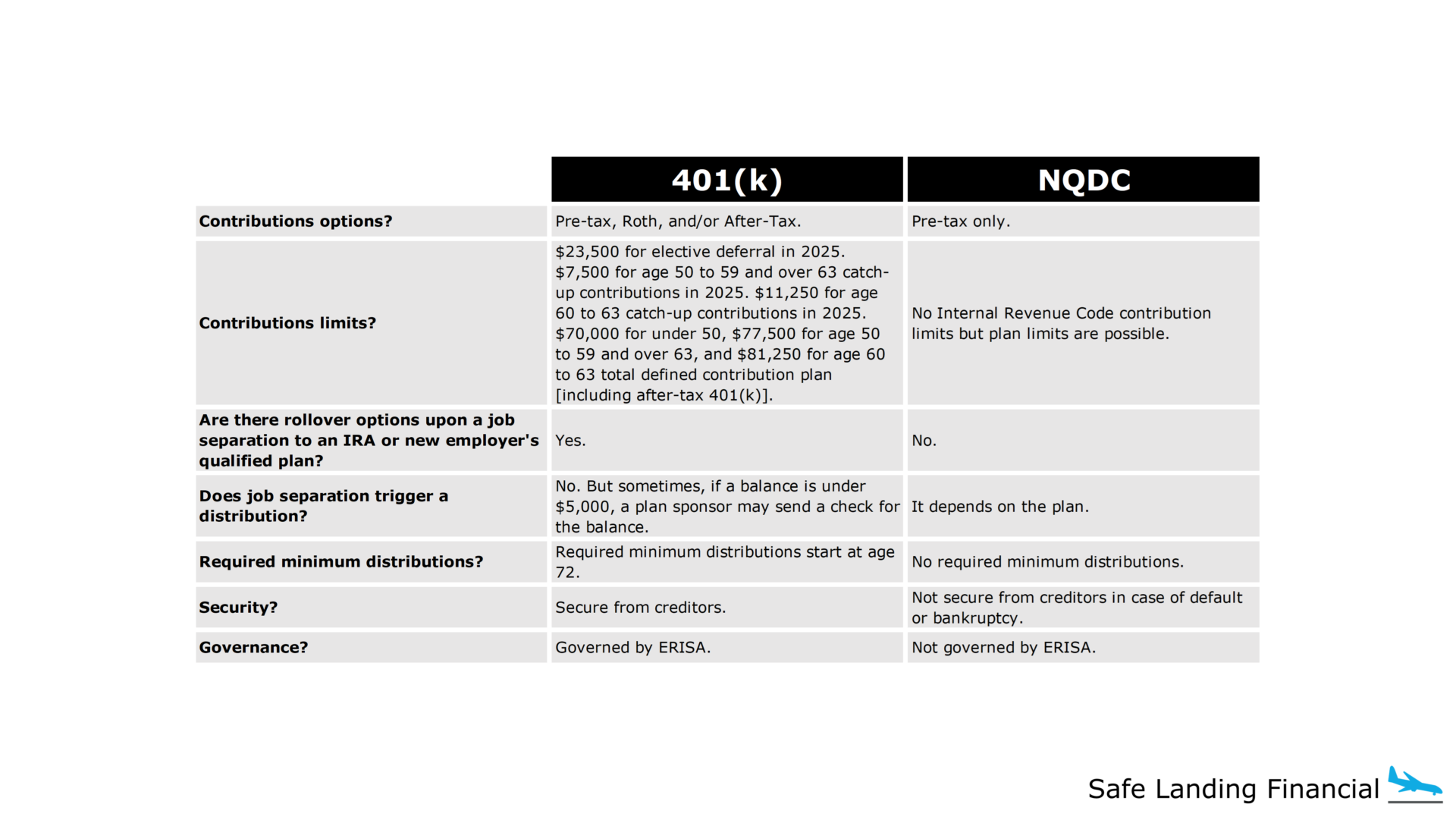

Is deferred compensation better than a 401(k)?

It depends. In most cases no. One should generally always max out their 401(k) before considering if they should participate in a nonqualified deferred compensation plan.

Like Texas Hold’em, there are no limits to nonqualified deferred compensation contributions.

In 2025, 401(k) plans limit individual contributions to $23,500 of elective deferrals. There is also a catch-up contribution of $7,500 for age 50 to 59 and above 63 or $11,250 for age 60 to 63. Including after-tax 401(k), an individual under age 50 can contribute $70,000 total. An individual age 50 to 59 or above 63 can contribute $77,500. An individual age 60 to 63 can contribute $81,250. See mega-backdoor Roth guide for more information.

If you’re a high-earner with the ability to save aggressively, a more appropriate question might be is NQDC better than a taxable brokerage? And the answer to that is… it depends.

What are some considerations before investing in deferred compensation?

Here are some considerations:

- If the company goes bankrupt… then participants are treated as an unsecured creditor. Good luck!

- There is a potential “tax bomb” if the company experiences a merger or acquisition.

- There is a potential “tax bomb” upon separation of the employer. It’s important to consider job security and confirm a desire to stay with the company.

- There is an opportunity cost of paying taxes today and investing the money in a taxable brokerage account.

- Individuals may find their future tax rates are higher than current tax rates.

- There are investment risks for funds within a deferred compensation plan. There is no guarantee on investment performance. And there is no guarantee that a deferred compensation plan offers the best investment options.

- Like a 401(k), a deferred compensation plan may have hidden costs.

Nonqualified Deferred Compensation Case Study

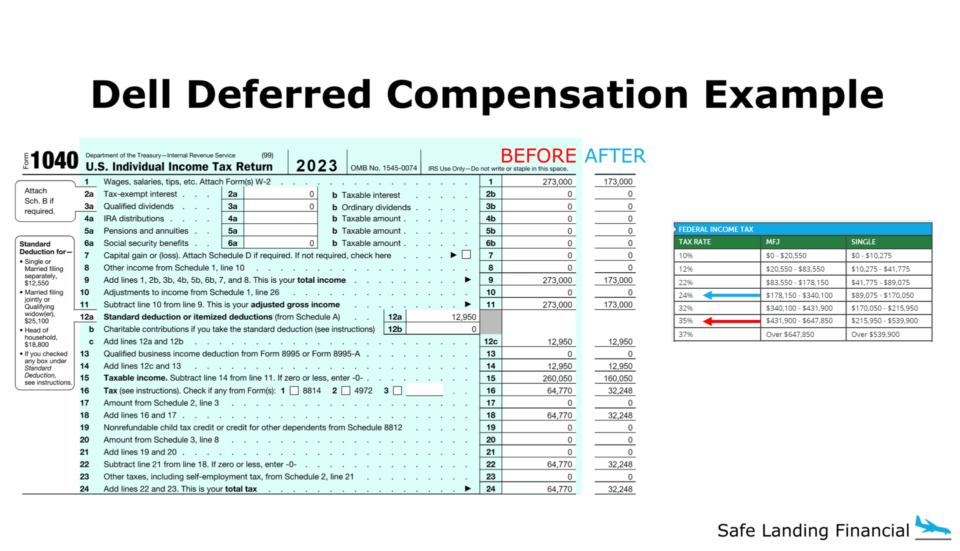

Jared (56) is a single distinguished engineer at Dell.

Jared is an aggressive saver that is currently maxing out his 401(k) and is looking for additional ways to save tax-efficiently and position himself for early retirement.

Jared is planning to retire in five years. Jared is comfortable with the risks in deferred compensation. Jared’s tax projections show a lower expected tax rate in early retirement years than in high-income years.

For 2025, Jared expects to earn $240,000 in base pay, another $60,000 in bonus, and approximately $60,000 in vesting RSUs. Jared expects to use the standard deduction.

By working closely with his financial advisor and CPA to better understand his current and future tax projections, Jared chooses to enroll in Dell’s Deferred Compensation plan to save around $120,000 towards retirement and lower his federal marginal tax rate from 35% to 24%.

Final Thoughts on NQDC

Participating in a NQDC plan can make financial sense if…

- There is a current year tax benefit.

- Future taxes are projected at lower rates.

- You are already diversified and participating in other investment accounts.

- You can afford to risk never receiving NQDC if your employer goes bankrupt.

- You are close to low-income, gap, or retirement years.

Deferred compensation doesn’t make sense in every scenario. Understanding your unique financial situation and tax planning picture allows for a better decision-making process and can help you determine how to best move forward.

More Resources

2025 Important Planning Numbers (free PDF resource)

RSU Guide + Strategy After Vesting

Mega-Backdoor Roth Guide

HSA Guide + Strategy for Reimbursement

Backdoor Roth Guide

Fidelity Timing Deferred Compensation

Safe Landing Financial Newsletter

Sign up for monthly planning insights for tech professionals and pre-retirees!