Estate Planning

Potential Estate Planning Gaps

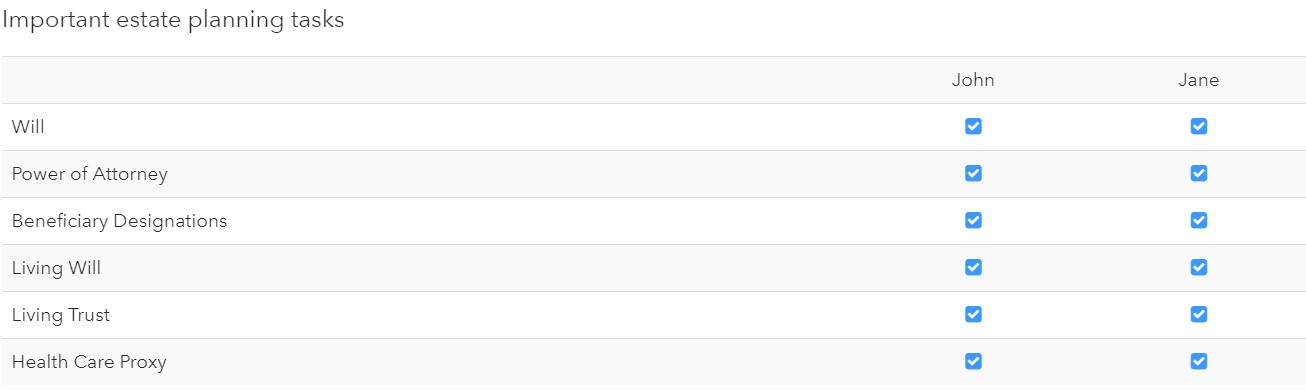

Safe Landing Financial’s evaluates your complete financial picture to avoid potential estate planning gaps and arrange for assets to flow in the direction of your choice for when you pass away.

The best time to plan is now. If you have an outdated plan or no plan at all, your state may choose how to distribute your assets, and it may not be how you prefer to leave your legacy. It’s important to ensure your wishes are carried out while you can.

We identify your estate planning goals through a collaborative process. Then, we ensure you have the appropriate documents to avoid potential estate planning gaps and arrange for assets to flow in the direction of your choice for when you pass away.

We can work directly with your estate planning attorney to make your financial life run more smoothly. There are no hidden fees.

Are you looking for a fiduciary to evaluate your complete financial picture to avoid potential estate planning gaps?

More on Estate Planning

Why Working With a Fiduciary Financial Advisor Is Important

Why Working With a Fee-Only Financial Advisor Is Important

Why CERTIFIED FINANCIAL PLANNER™ Is Important (CFP® Professional)

Important Numbers for 2023 (printable PDF guide)

Investopedia: 4 Reasons Estate Planning Is So Important

Trust and Will: How to Create Your Own Digital Estate Plan

Other Services

Service Packages ✓ Financial Planning ✓ Retirement Planning ✓ Investment Management ✓

Social Security Optimization ✓ Tax Planning ✓ Insurance Planning ✓ Estate Planning ✓

FREE FINANCIAL PLANNING CONSULTATION

A complimentary 4-step process sharing how to minimize

taxes, optimize investments, and enjoy retirement on your terms.

This process is designed to help you evaluate our services

and make an informed choice for planning your financial future.