HSA Guide to Triple-Tax Advantage + Strategy for Reimbursement (2024 Update)

The triple-tax advantage for Health Savings Accounts (HSAs) allows individuals save efficiently for retirement. Despite the significant benefits, recent studies suggest that only 10% of Americans utilize HSAs, even though they were introduced in 2003.1

So if you want answers like…

- Am I eligible for an HSA?

- What is the triple-tax advantage for HSAs?

- What are other important planning considerations for HSAs?

… then this guide is for you!

HSA Eligibility

Individuals covered by an HSA-eligible high-deductible health plan are eligible to contribute to an HSA.

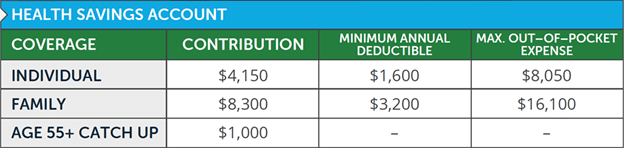

2024 HSA Contribution Limits

In 2024, an eligible individual can contribute $4,150 into an HSA. At age 55 or above, individuals can contribute an additional $1,000.

Eligible individuals can contribute $8,300 collectively to an HSA for family coverage.

Employer HSA matches count toward these totals.

Source: 2024 Important Planning Numbers

HSA Triple-Tax-Advantage

When it comes to tax benefits, no other savings vehicle offers the triple tax-advantage found from HSAs.

Pre-Tax Contributions

Contributions to an HSA are made on a pre-tax basis.

Tax-Deferred Growth

HSA accounts grow on a tax-deferred basis.

Once an HSA balance exceeds $1,000, plans generally allow individuals to invest funds and enjoy tax-deferred growth. Many employer HSAs offer a menu of investment options like a 401(k) plan, while other HSAs provide more extensive choices beyond that.

HSA funds are not use-it-or-lose-it. Unused HSA assets roll over automatically each year, and they are portable, allowing for transferring to other custodians.

Tax-Deferred Growth

Withdrawals from an HSA are tax-free when used for qualified medical expenses, such as prescription medications, doctor visits, and long-term care insurance premiums.

Example of HSA Triple-Tax Advantage

Kelly Lifestyle (48 years old) and her husband Eric (50) are enrolled in an HSA eligible high-deductible health plan.

Kelly contributes $6,800 throughout the year and receives an employer match of $1,500 to max-out her HSA. Kelly and Eric are in the 32% federal tax-bracket. By maxing out their HSA, not only do they save tax-efficiently for retirement, but they also save over $2,000 in taxes by reducing their taxable income.

Kelly chooses to invest her HSA for long-term growth once it’s over the $1,000 required minimum. Similar to an IRA or 401(k), investments within the HSA grow tax-deferred.

Because Kelly and Eric accrue qualified medical expenses and keep their receipts, they do not owe taxes down the road when they distribute HSA funds.

Important HSA Considerations

An HSA is Not For Everyone

While saving with an HSA can be a smart financial move for many, it’s important to note that it’s not for everyone. To contribute to an HSA, you must enroll in a high-deductible health plan. Those facing complex healthcare needs, prefer traditional health plans, are already Medicare enrollees, or are in large families frequently visiting the doctor might find that high-deductible health plans are not a good fit.

Reimbursements in the Future vs. in the Present

As of 2024, there’s no deadline for reimbursement. Consider paying for qualified medical expenses out-of-pocket if there is an established adequate emergency fund in place. Having a growing bucket of tax-advantaged funds available for reimbursement is a significant advantage for HSAs over other investment account types.

It’s critical to retain receipts for qualified medical expenses. Some HSAs ask for submitting receipts through their platform. It’s also wise to keep digital copies to account for potentially switching HSA custodians in the future.

Withdrawals for Non-Qualified Medical Expenses

After reaching age 65, non-qualified HSA withdrawals are taxed as ordinary income.

Before reaching age 65, non-qualified HSA withdrawals are taxed as ordinary income plus a 20% tax penalty.

Inheriting an HSA

Spouses inheriting an HSA receive the account with no tax implications.2 Non-spouses inheriting an HSA must distribute the funds and pay ordinary income tax rates based on the distribution.2

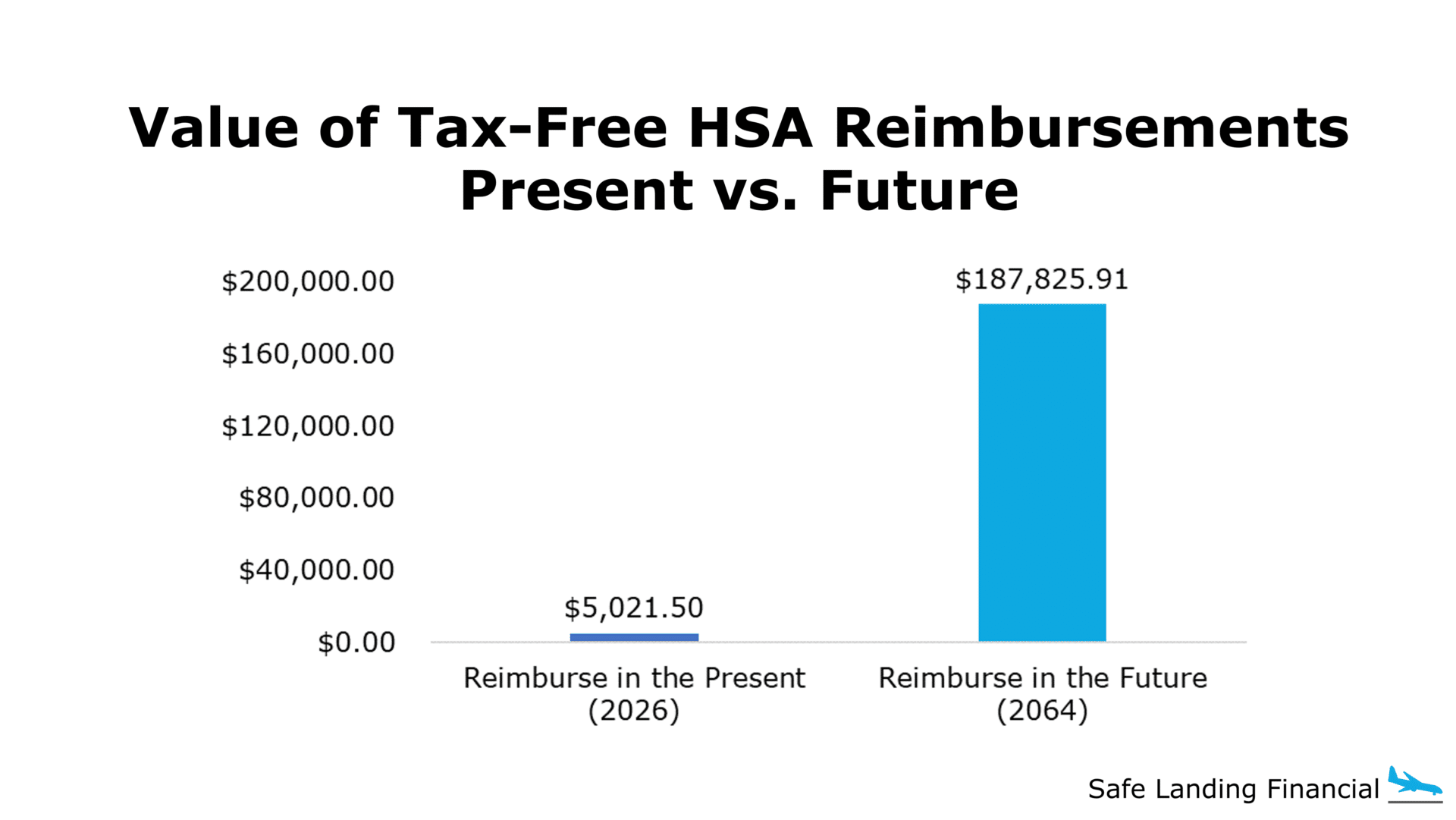

Example of HSA Reimbursement in the Present vs. Future

Kendall Roy, age 45, is on an HSA-eligible high-deductible health plan in 2024 and makes a $4,150 contribution. Kendall’s HSA allows him to invest the entire balance once accumulating over $1,000. Kendall has an adequate emergency fund and can afford to pay out-of-pocket.

In 2025, he switches health plans and remains ineligible for future HSA contributions.

In 2026, he has $5,021.50 in qualified medical expenses and is trying to determine whether to reimburse from the HSA in the present OR pay out-of-pocket and reimburse from the HSA in the future. If he reimburses in the future, Kendall estimates that he can receive a 10% annual rate of return and that he won’t need the funds until reaching age 85 in 2064.

By waiting until age 85 to reimburse himself, Kendall’s $5,021.50 in 2026 grew to $187,825.91. Over that timeline, Kendall saved other receipts for qualified medical expenses and is eligible to reimburse the entire amount tax-free.

FREE FINANCIAL PLANNING CONSULTATION

A complimentary 4-step process sharing how to minimize

taxes, optimize investments, and enjoy retirement on your terms.

This process is designed to help you evaluate our services

and make an informed choice for planning your financial future.

More Resources

Can I Make a Deductible Contribution to My HSA? (Free PDF)

Will the Distribution From My HSA be Tax & Penalty-Free? (Free PDF)

Restricted Stock Unit Guide

Mega-Backdoor Roth Guide

Backdoor Roth Guide + Flowchart

Deferred Compensation Guide + Case Study

Guide for HSAs at Dell

Aetna Full list of qualified medical expenses.

1: American for Prosperity Why 90% of Americans lack access to health savings accounts

2: Lively If I have an HSA and I die, what happens?

Safe Landing Financial Newsletter

Sign up for monthly planning insights for tech professionals and pre-retirees!