Restricted Stock Units at Dell

Learn everything Dell employees need to know about their restricted stock units, including: how it works, the vesting schedule, tax consequences, and what to do after RSUs vest.

Dell’s restricted stock units offer the ability for employees to earn additional compensation beyond base salary and bonus. It serves as a powerful tool to incentivize employees to stay with and grow with the company long-term. Depending on the performance of Dell’s stock, the restricted stock units can fluctuate in value.

How Dell’s Restricted Stock Units Work

RSUs follow a vesting schedule with two critical dates known as the grant date and vesting date.

The grant date is the day an employer promises to give a specific number of shares in the future based on a vesting schedule.

The vesting date is the day that you officially become the owner of the granted shares of stock.

Certain events may prevent you from reaching the vesting date and receiving the vested shares, such as separation, disability, and death.

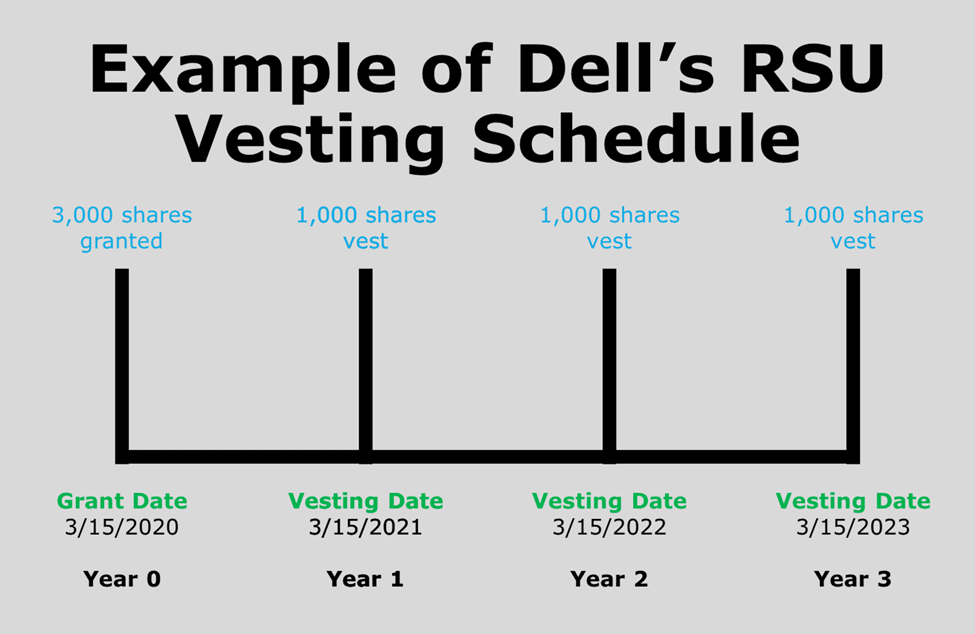

Dell’s Restricted Stock Unit Vesting Schedule

Dell RSUs follow a three-year vesting schedule with one-third of granted shares vesting after year one, one-third of granted shares vesting after year two, and one-third of granted shares vesting after year three.

Dell RSU Grant Date

The grant date is the day Dell promises to give shares of Dell stock in the future. While the date varies depending on the RSU grant event, the grant date is typically set as March 15th.

Dell RSU Vesting Date

The vesting date is the day that you officially become the owner of the granted shares of Dell stock. One-third of the granted RSUs vest on the anniversary of each year following the after the grant date for three-year period.

How Are Dell RSUs Taxed?

Dell RSUs have two tax triggers at vesting and selling. RSU grants are not taxable.

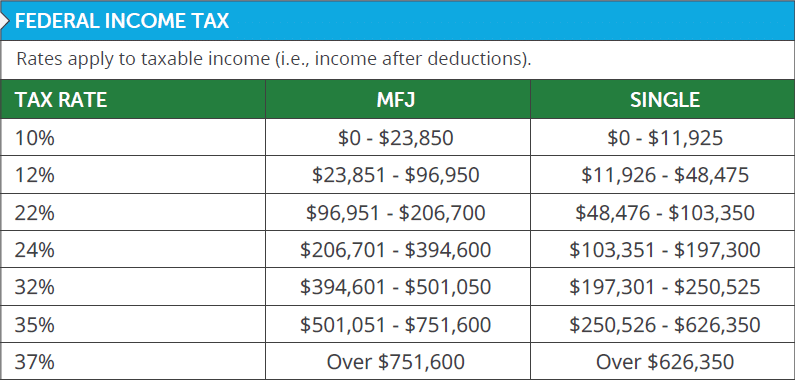

When RSUs vest, they are taxed at your ordinary income tax rate. When shares vest, you’ll owe taxes for: federal, Social Security, Medicare, state, and local taxes.

Source: 2025 Important Planning Numbers

If you sell shares right at vesting, then there are no taxable consequences for capital gains in most situations.

Selling after vesting causes taxable consequences for recognizing capital gains.

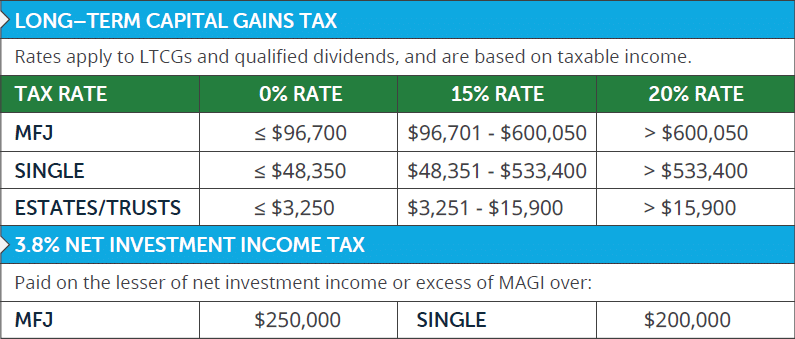

If held for under one year, selling vested RSUs causes a short-term capital gain which is taxed at your highest marginal tax rate.

If held for over one year, selling vested RSUs causes a long-term capital gain, which is generally taxed at 15% or 20% based on your income level.

Source: 2025 Important Planning Numbers

If you’re receiving RSUs, then it’s important to be aware of the net investment income tax (NIIT) when selling RSUs. NIIT is an additional 3.8% tax for capital gains on modified adjusted gross income above $250,000 for married filing jointly or $200,000 for individuals.

Example of How Dell RSUs Work

Kelly Lifestyle is a Distinguished Engineer at Dell. She was granted 3,000 shares of Dell stock on March 15, 2020. Kelly prefers to sell shares right at vesting to avoid concentrated stock risk and additional capital gains considerations. Here’s a look at the tax consequences for Dell’s RSUs.

Dell RSU Grant Date

March 15, 2020 – The average share price of Dell’s stock on March 15, 2020 is $16.09 per share. Dell grants 3,000 shares. The value of Kelly’s unvested RSUs is $48,270.

Tax consequences: There are no tax consequences for RSUs on the grant date.

Dell RSU Vesting Date Year 1

March 15, 2021 – The opening price of Dell’s stock on March 15, 2021 is $44.98 per share. 1,000 RSUs vest while 2,000 RSUs remain unvested. The value of Kelly’s vested RSUs is $44,980 while the value of Kelly’s unvested RSUs is $89,960. Kelly sells all vested shares right at vesting.

Tax consequences: Kelly has $44,980 of ordinary income that is recognized and taxed at ordinary income tax rates. Because she sells the 1,000 RSUs right at vesting, she does not owe any capital gains tax.

Dell RSU Vesting Date Year 2

March 15, 2022 – The opening price of Dell’s stock on March 15, 2022 is $50.74 per share. 1,000 RSUs vest while 1,000 RSUs remain unvested. The value of Kelly’s vested RSUs is $50,740 while the value of Kelly’s unvested RSUs is $50,740. Kelly sells all vested shares right at vesting.

Tax consequences: Kelly has $50,740 of ordinary income that is recognized and taxed at ordinary income tax rates. Because she sells the 1,000 RSUs right at vesting, she does not owe any capital gains tax.

Dell RSU Vesting Date Year 3

March 15, 2023 – The opening price of Dell’s stock on March 15, 2023 is $36.92 per share. 1,000 RSUs vest and 0 RSUs remain unvested. The value of Kelly’s vested RSUs is $36,920. Kelly sells all vested shares right at vesting.

Tax consequences: Kelly has $36,920 of ordinary income that is recognized and taxed at ordinary income tax rates. Because she sells the 1,000 RSUs right at vesting, she does not owe any capital gains tax.

Planning Opportunity for Dell RSUs

Should I Sell or Keep RSUs After Vesting?

It depends.

As a Dell employee, you may not have the opportunity to buy Dell’s stock unless the shares are received from stock options.

Consider the impact of a concentrated stock position within your portfolio.

Consider how RSUs play into your long-term financial plan.

Unless you have a strong opinion towards keeping Dell’s stock, it may make sense to sell RSUs at vesting and to diversify. Remember, RSUs are just another form of income.

There are no additional incentives to keep the RSUs past vesting unless you believe Dell’s stock is going to outperform the rest of the stock market. A diversified portfolio is much safer for planning one’s financial future.

Dell RSU Tax Withholding

Fidelity may automatically sell 22% of RSUs at vesting for tax withholding. In many cases, this is not enough tax withholding for high-earners receiving RSUs. If that’s the case for your unique situation, then Fidelity does have the ability to adjust the amount sold at vesting for tax withholding.

Dell RSU Tax Planning

High-earners need to be especially cognizant of recognizing capital gains, and specifically short-term capital gains.

Capital losses are used to cancel out other capital gains. If capital losses exceed your capital gains at the end of the year, then you can claim up to $3,000 in losses to lower your taxable income. Losses beyond $3,000 carry forward to future tax years to help cancel out future capital gains and lower taxable income.

If you’re a Dell employee and have questions about restricted stock units, feel free to contact me at [email protected].

More Resources

What Issues Should I Consider Regarding My Restricted Stock Units? (Free PDF resource)

What Issues Should I Consider With My Employer-Provided Benefits? (Free PDF resource)

2025 Important Planning Numbers? (Free PDF resource)

Financial Planning for Dell Employees

401(k) at Dell

Mega-Backdoor Roth 401(k) at Dell

HSA at Dell

Deferred Compensation Plan at Dell

Disability Insurance at Dell

Life Insurance at Dell

Mega-Backdoor Roth Guide

Backdoor Roth Guide

Deferred Compensation Guide + Case Study

HSA Guide + Strategy for Reimbursement

RSU Guide + Strategy After Vesting

Disclosure: Even though many of our clients are current and former Dell employees, Safe Landing Financial is not affiliated, associated, or endorsed by Dell. This information is supplied from sources that we believe to be reliable, however, we cannot guarantee the accuracy. All information is subject to change without notice. Please refer to your Dell benefits guide for up-to-date information.