529 Plan for Higher Education

Planning for college is an expensive thought whether you’ve got a newborn, toddler or teenager. For 2018, tuition and fees at the University of Texas at Austin were $10,398 for Texas residents and $36,744 for out-of-state undergraduate students. While there are many account types that can be used to pay for higher education, 529 plans offer the most flexibility, freedom and savings when paying for college. As a financial planner in Austin, TX, college planning is an important consideration for families.

529 College Planning Considerations

A 529 plan is a tax-advantaged savings plan, created in 1996, to incentivize saving for higher education costs. In this article, I will review how utilizing a 529 plan adds incredible value when planning for college expenses.

Start Saving Early

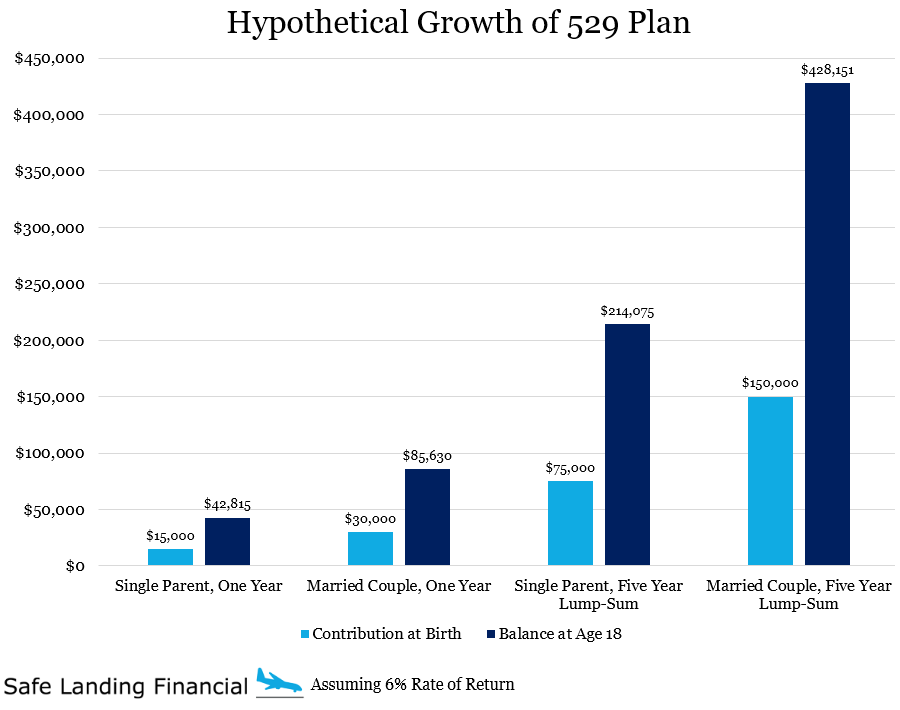

The earlier you start saving, the longer your investments will have time to grow and cover rising costs of college. Contributions made to 529 plans are considered present interest gifts and qualify for the annual federal gift tax exclusion ($15,000 per year in 2019). A married couple can contribute $30,000 to a 529 plan under the annual gift tax exclusion in 2019. While not everyone has the ability to contribute the maximum amount, every dollar counts. It’s best to start contributing early and plan to add contributions within your monthly or annual budget.

Five Year Lump-Sum Contribution

529 plans are particularly attractive for families that have the ability to contribute a large amount. Individuals can make a tax-free contribution of up to five times the annual gift tax exclusion and elect to spread the gift evenly over five years. This amounts to an up-front contribution of $75,000 from an individual or $150,000 from a married couple in 2019. No other financial account offers this level of tax savings in planning for higher education expenses.

Qualified Education Expenses

When used to pay for qualified education expenses, assets in a 529 plan can grow and be withdrawn tax-free. Qualified education expenses include:

- Tuition for students at accredited institutions

- Room and Board if the student is attending college half of the time or more

- 100% covered if paid directly to college or university

- If living off-campus and paying for food, see the budget set by the school

- Technology

- Includes: computer, printer and internet service

- Does not include cell phones

- Books and Supplies

Be aware of the tax consequences for a non-qualified distribution. The earnings from a non-qualified distribution are taxed as ordinary income plus an additional 10% penalty.

For More:

Learn more about financial planning services

What is a fiduciary financial advisor?

Saving for College: Name the top 7 benefits of 529 plans

Austin, TX Financial Planner and College Planning

Still have questions in how a 529 plan can be used within your unique financial situation? Meet with a fee-only financial planner in Austin, TX or online to discuss college planning.

by Brian Fry CFP®

Safe Landing Financial is a Los Angeles, CA fee-only financial advisor providing financial planning, retirement planning and investment management to tech professionals and pre-retirees. When you work with Safe Landing Financial, you work with Brian Fry, a fiduciary and CERTIFIED FINANCIAL PLANNER™ that puts clients’ best interests first. Financial planning services include: retirement planning, charitable giving, asset protection, estate planning, saving for college, debt management, tax strategy and investment management. Safe Landing Financial serves as a virtual fee-only financial advisor to individuals and families nationwide.