Life Insurance at Dell

Learn everything Dell employees need to know about their basic life, accidental death & dismemberment (AD&D), and supplemental life insurance coverage.

Life insurance helps transfer the risk of unexpected death by providing financial compensation to beneficiaries impacted by the insured’s passing.

Dell’s Basic Life Insurance Policy

Dell covers two times your benefit-eligible earnings up to a maximum of $1.5 million, for basic life insurance with MetLife.

If you are employed and reach the age of 70, life insurance benefits are reduced to 65% coverage.

Dell’s Accidental Death & Dismemberment (AD&D) Insurance Policy

Dell covers two times your benefit-eligible earnings, up to a maximum of $1.5 million, for AD&D insurance with AIG.

If you are employed and reach the age of 70, AD&D insurance benefits are reduced to 65% coverage.

AD&D insurance pays beneficiaries only in the event of accidental death or permanent dismemberment resulting from an accident. This policy does not provide coverage for disability or death caused by health issues.

Dell’s Supplemental Life Insurance Policy

Dell’s supplemental life insurance policy offers the ability to purchase additional coverage at a negotiated rate through MetLife. You can purchase up to eight times your benefit-eligible earnings, up to a maximum of $3 million. Any increase during annual enrollment requires evidence of insurability.

Dell’s supplemental life policy also offers the ability to get coverage for your spouse or domestic partner, for up to $500,000 in coverage, and eligible child dependents.

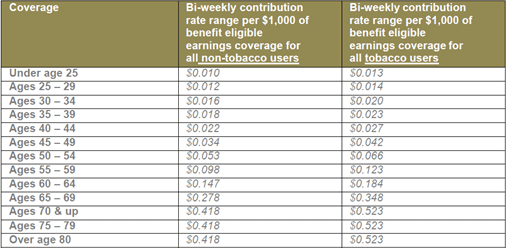

Here are the 2023 rates for Dell’s supplemental policy coverage.

Source: 2023 Supplemental Life premiums from Well at Dell

Example of Dell’s Supplemental Life Policy

Kelly Lifestyle is 48 years old and earns $250,000 in benefit-eligible earnings at Dell. Kelly determines that she needs $1 million in life insurance coverage to protect her family.

Dell’s basic life insurance covering $500,000, she requires an additional $500,000 in coverage from Dell’s supplemental life policy. Kelly is not a tobacco user.

The cost for Kelly’s supplemental coverage is $17 per bi-weekly paycheck or $442 per year.

Planning Opportunity for Dell’s Life Insurance Coverage

Group basic life and AD&D policies do not offer portability, which means you’re not covered once you’re no longer working at Dell. However, Dell’s supplemental life insurance policy is eligible for portability, allowing you to continue paying for the policy even after leaving Dell. Rates may vary after separation.

If you require additional life insurance coverage, then consider Dell’s supplemental life policy for an affordable solution. The portability of the supplemental life insurance provides protection for you and your family for life after Dell.

Take the time to determine the right amount and type of life insurance for your needs. Consulting with a fiduciary financial planner can help provide peace of mind for you and your family.

If you’re a Dell employee and have questions about life insurance options, feel free to contact me at brianfry@safelandingfinancial.com.

More Resources

What Issues Should I Consider When Purchasing a Life Insurance Policy? (Free PDF)

What Issues Should I Consider With My Employer-Provided Benefits? (Free PDF)

Financial Planning for Dell Employees

Restricted Stock Units at Dell

401(k) at Dell

Mega-Backdoor Roth 401(k) at Dell

HSA at Dell

Disability Insurance at Dell

Mega-Backdoor Roth Guide

Backdoor Roth Guide

Deferred Compensation Guide + Case Study

HSA Guide + Strategy for Reimbursement

RSU Guide + Strategy After Vesting

Investopedia Life Insurance: What It Is, How It Works, and How To Buy a Policy

Disclosure: Even though many of our clients are current and former Dell employees, Safe Landing Financial is not affiliated, associated, or endorsed by Dell. This information is supplied from sources that we believe to be reliable, however, we cannot guarantee the accuracy. All information is subject to change without notice. Please refer to your Dell benefits guide for up-to-date information.