Retirement Planning

Retirement Planning Process

Safe Landing Financial helps you reach your financial goals while ensuring you don’t run out of money during retirement. We want to give you financial peace of mind to allow you to focus more on what you’re passionate about. Our retirement planning process includes:

- Mapping out your cash flows for saving, spending, and retirement income.

- Stress-testing for market crashes, higher taxes, higher healthcare expenses, higher inflation, a reduction in Social Security benefits, and living longer.

- Determining the optimal Social Security filing strategy based on specific retirement needs.

- Identifying a tax-efficient retirement income distribution plan, including Roth conversions.

- Developing an investment and rebalancing strategy to keep you on track to and through retirement.

- Aligning all areas of your financial life to limit potential gaps and stay successful during retirement.

Monte Carlo Simulations

Safe Landing Financial uses advanced financial planning software to build your plan, track the plan’s success, run stress tests, and determine actionable next steps.

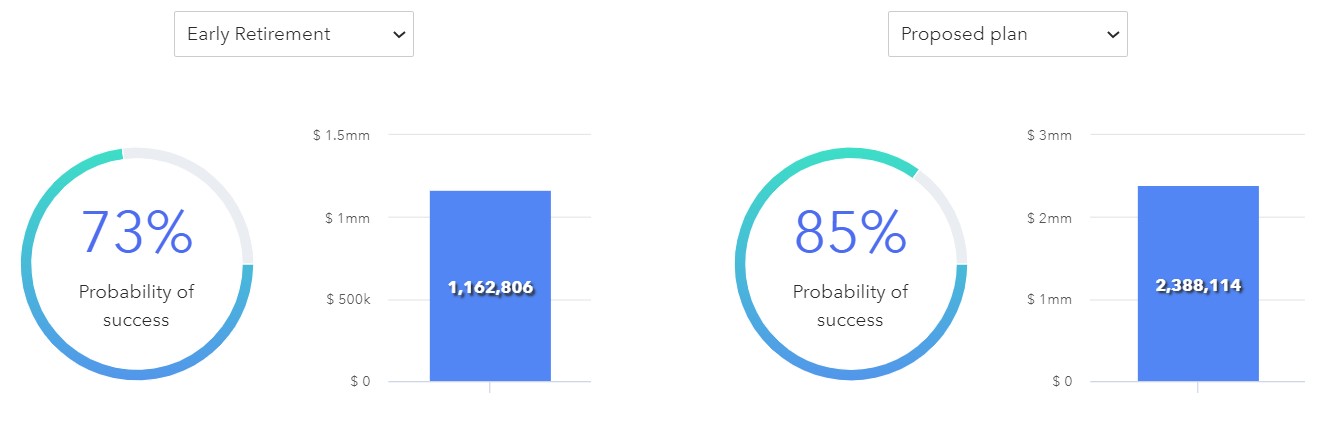

We run Monte-Carlo simulations to identify the probability of your savings lasting through retirement. Next, we compare different scenarios to give you confidence for achieving financial goals such as early retirement, travel, buying a second home, etc. Finally, we strategize ways to improve the success rate of your financial plan.

Tax-Efficient Retirement Income Strategy

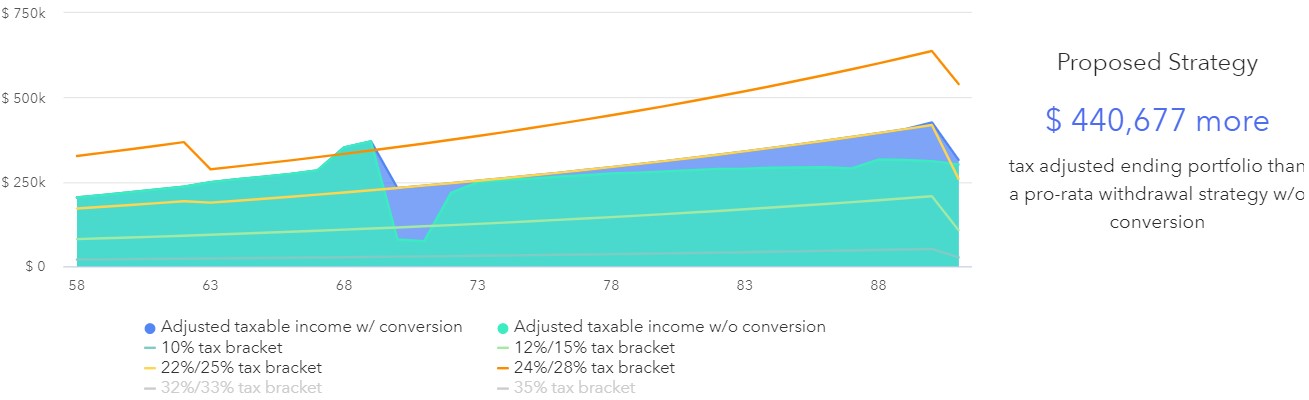

Safe Landing Financial identifies tax-efficient retirement income distribution strategy for your unique strategy. Your strategy for withdrawing retirement assets is as important as your strategy for accumulating them.

Taxes during retirement can be higher than expected. We can help you save more money in lower income years with a sequential distribution strategy and utilizing Roth conversions.

Want to learn more about planning for tax-efficient retirement income distribution strategy?

Disclosure: The above Monte Carlo simulation and tax-efficient retirement simulation is hypothetical and does not involve an actual Safe Landing Financial client. No part of this content should be taken as a guarantee that their household will experience similar results if Safe Landing Financial is chosen to provide financial planning services.

More on Retirement Planning

Why Working With a Fiduciary Financial Advisor Is Important

Why Working With a Fee-Only Financial Advisor Is Important

Why CERTIFIED FINANCIAL PLANNER™ Is Important (CFP® Professional)

Important Numbers for 2023 (printable PDF guide)

Approaching Retirement – Financial Planning for Retirement Case Study

At Retirement – Planning in Retirement Case Study

How Far Could $1 MILLION Go in Retirement?

The “Social Security Elephant” in the Room: When, Why, and How Should I File for Social Security?

Fidelity: How to Plan For Rising Health Care Costs

Genworth: Cost of Long-Term Care Study

FREE FINANCIAL PLANNING CONSULTATION

A complimentary 4-step process sharing how to minimize

taxes, optimize investments, and enjoy retirement on your terms.

This process is designed to help you evaluate our services

and make an informed choice for planning your financial future.