401(k) Plan at Dell

Saving in a 401(k) plan provides a tax-advantaged way to build a nest egg, allowing individuals to benefit from compound growth and better plan for retirement.

Learn everything Dell employees need to know about their 401(k) plan, including: how it works, contribution limits, investing considerations, and the planning opportunity.

How Dell’s 401(k) Plan Works

Eligibility and Vesting

Eligible team members can participate in the 401(k) plan from the date of hire or rehire.

You are fully vested for all your contributions, including pre-tax 401(k), Roth 401(k), after-tax, rollovers/direct transfers from other plans, and catch-up contributions (as applicable).

You are also fully vested for any company contributions, such as matching contributions, retirement savings contributions, top-heavy contributions, and true-up matching contributions (if applicable).

Dell’s 401(k) Provider

Dell’s 401(k) provider is Fidelity Net Benefits (Fidelity Investments).

Employer Match

Dell matches 6% of pre-tax and/or Roth 401(k) contributions dollar-for-dollar up to $7,500 annually.

Elective Deferrals

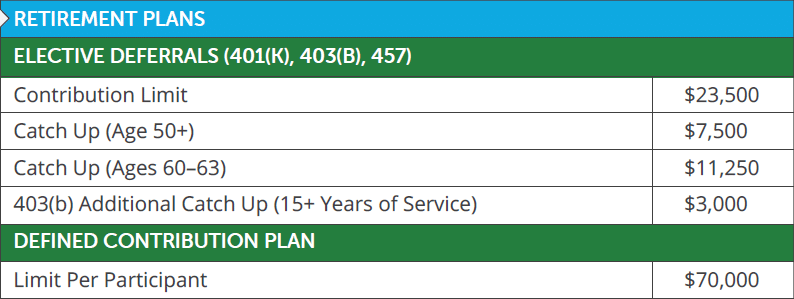

Pre-tax and Roth 401(k) contributions are limited to $23,500 in 2025.

Pre-Tax Contributions

Participants making pre-tax contributions receive an income tax reduction for the year that contributions are made. Pre-tax 401(k) grows tax-deferred and is taxed as ordinary income when distributed from the plan during retirement if certain requirements are met.

Roth Contributions

Roth 401(k) contributions are made on an after-tax basis. Roth 401(k) grows tax-free and then is distributed tax-free during retirement if certain requirements are met.

There are no income limits on the ability to contribute to a Roth 401(k), unlike a Roth IRA.

Catch-up Contributions

Individuals age 50 to 59 and over 63 are eligible to contribute an additional $7,500 in pre-tax or Roth 401(k) catch-up contributions.

Individuals age 60 to 63 are eligible to contribute an additional $11,250 in pre-tax or Roth 401(k) catch-up contributions.

After-Tax Contributions

Dell offers the ability to make after-tax contributions to 401(k). Unlike Roth contributions, after-tax contributions do not receive an employer match.

Dell’s 401(k) gives individuals the ability to save an additional $39,000 from after-tax contributions in 2025.

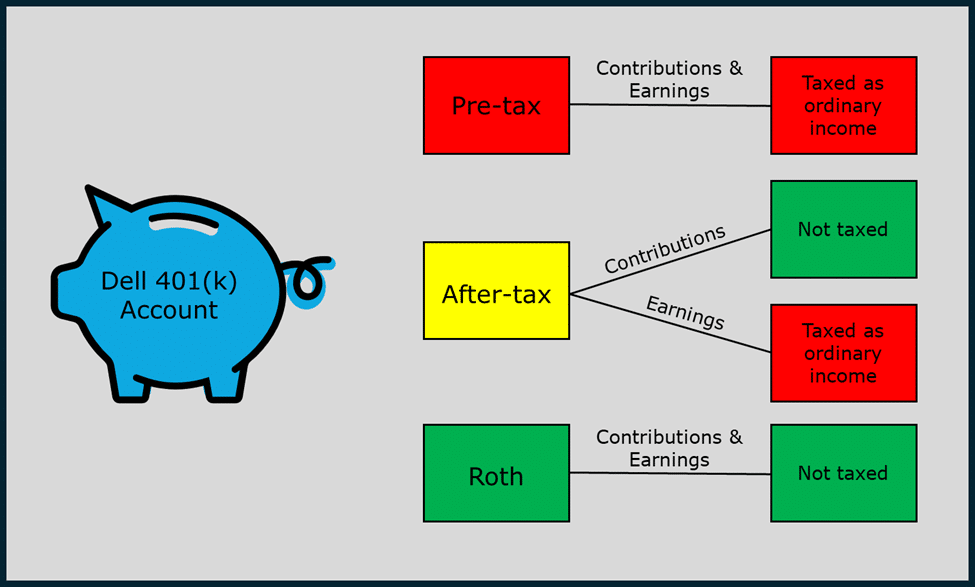

Taxes on 401(k) Distributions

In most situations, here is how contributions and earnings are taxed for pre-tax, after-tax, and Roth contributions:

- Pre-tax contributions and earnings are taxed at ordinary income rates.

- After-tax contributions are not taxed. After-tax earnings are taxed at ordinary income rates.

- Roth contributions and earnings are not taxed.

- You may face a 10% early withdrawal penalty for retirement account withdrawals before reaching age 59.5.

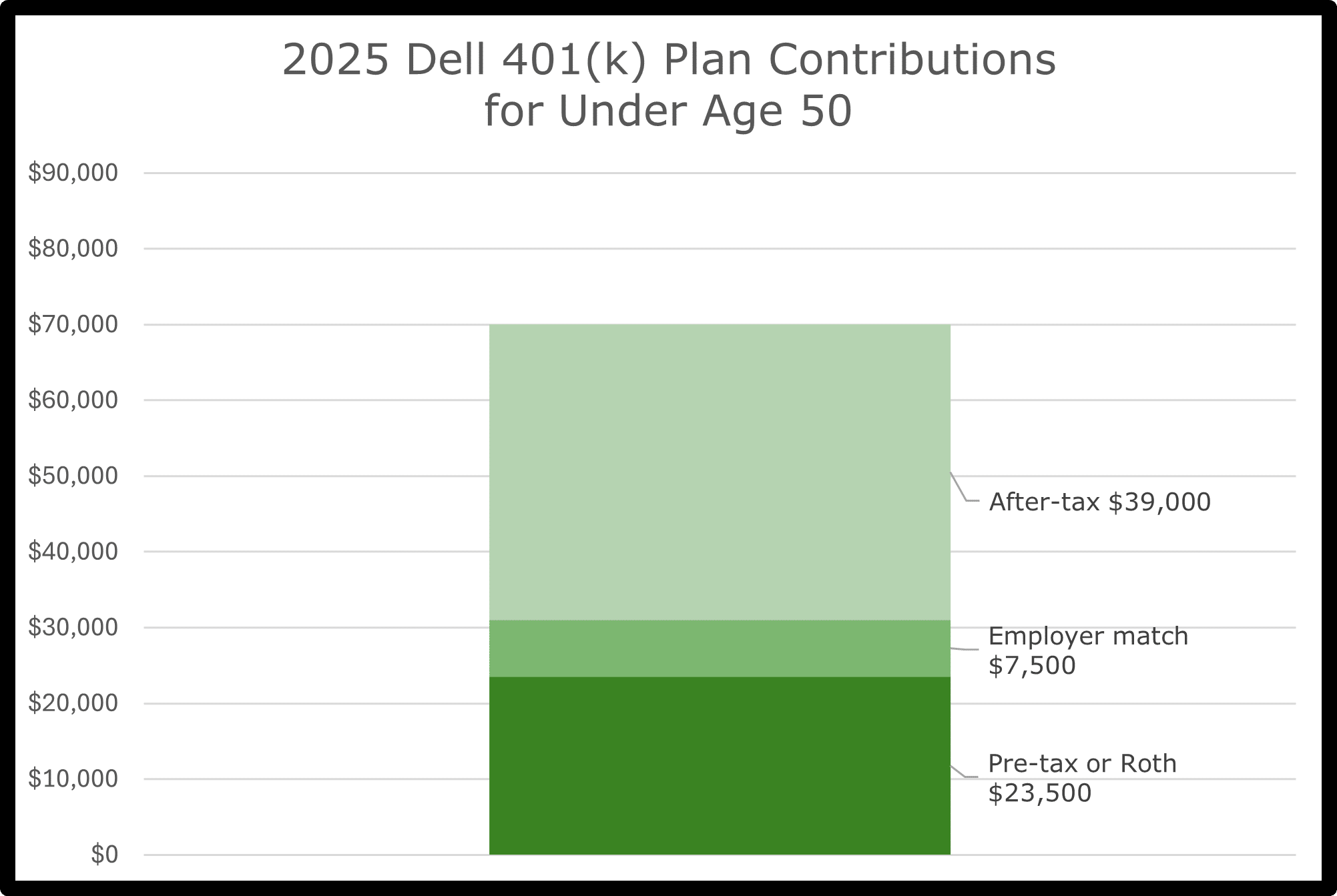

How Much Can You Contribute to the Dell 401(k) in 2025?

Individuals Under Age 50

- Individual pre-tax or Roth elective deferral 401(k) contributions: $23,500.

- Dell matches 6% of pre-tax and/or Roth 401(k) contributions dollar-for-dollar up to $7,500 annually.

- After-tax contributions: $39,000. Dell does not match after-tax 401(k) contributions.

- Total combined contributions: $70,000

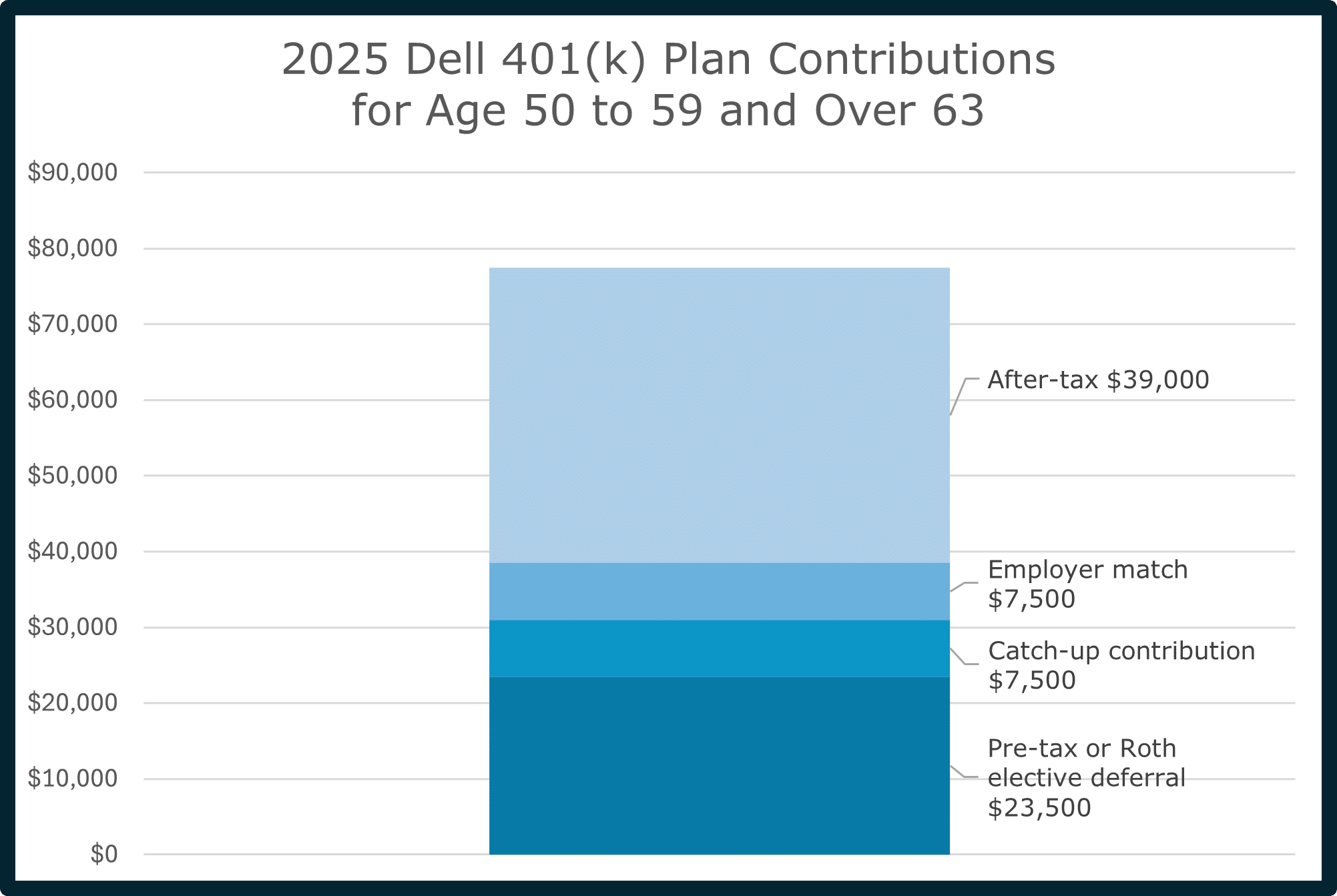

Individuals Age 50 to 59 and Over 63

- Individual pre-tax or Roth elective deferral 401(k) contributions: $23,500.

- Catch-up contributions: $7,500.

- Dell matches 6% of pre-tax and/or Roth 401(k) contributions dollar-for-dollar up to $7,500 annually.

- After-tax contributions: $39,000. Dell does not match after-tax 401(k) contributions.

- Total combined contributions: $77,500

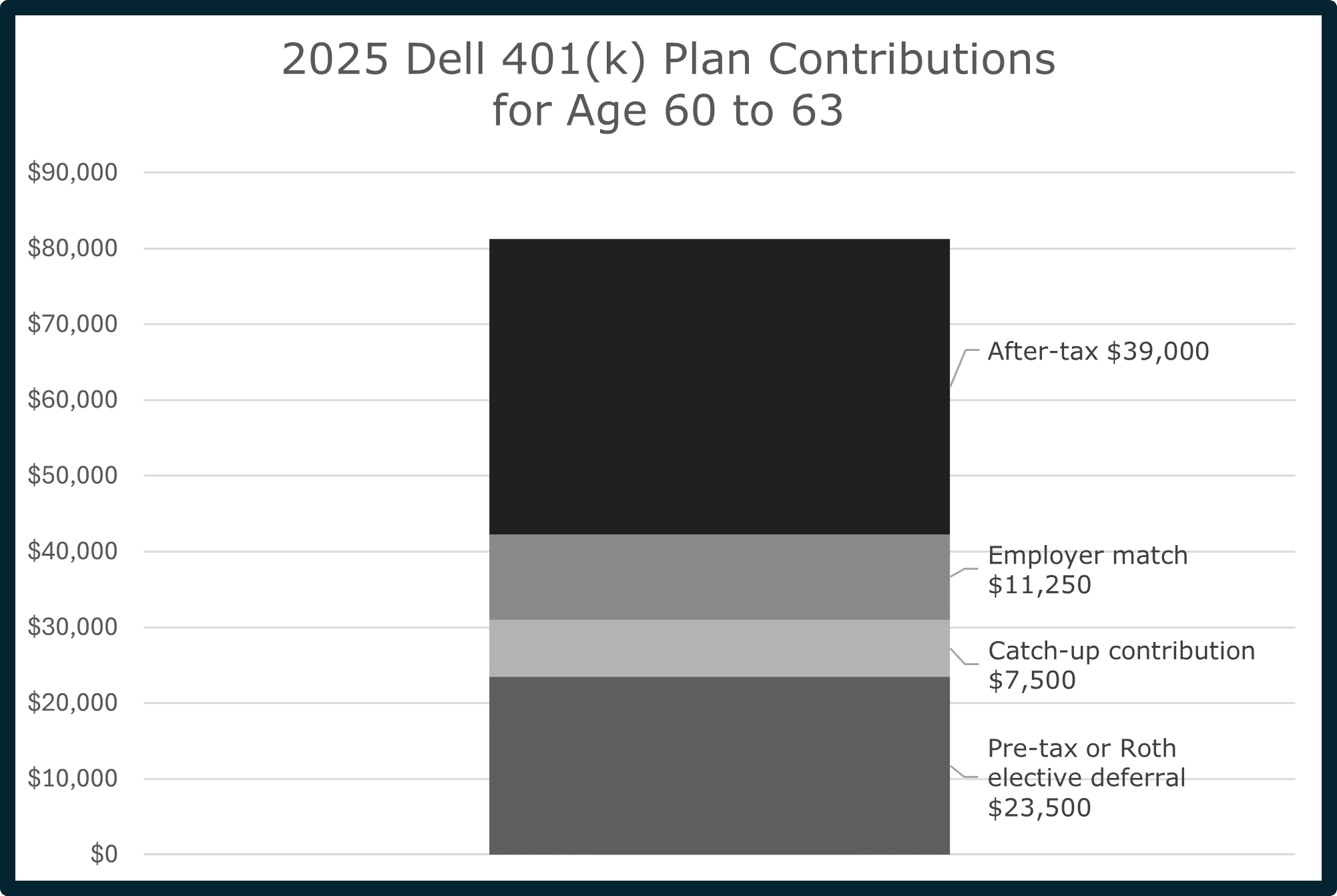

Individuals Age 60 to 63

- Individual pre-tax or Roth elective deferral 401(k) contributions: $23,500.

- Catch-up contributions: $11,250.

- Dell matches 6% of pre-tax and/or Roth 401(k) contributions dollar-for-dollar up to $7,500 annually.

- After-tax contributions: $39,000. Dell does not match after-tax 401(k) contributions.

- Total combined contributions: $81,250

Source: 2025 Important Planning Numbers

Investing in Dell’s 401(k)

The Dell 401(k) plan offers investment options for a variety of investment asset classes and strategies. The menu of investments includes passively managed funds, actively managed funds, and target-date funds.

How Should I Invest in the Dell 401(k)?

Safe Landing Financial specializes in assisting Dell employees in finding the right mix of investments for Dell’s 401(k) and their overall investment portfolio. To determine what’s right for your 401(k), it’s essential to have a clear picture of your unique financial situation.

Some factors to consider when making investment choices for your 401(k) include:

1. Asset Allocation

On a broad level, asset allocation is a term used to compare the overall mix of equity (stocks), fixed income (bonds), and cash alternatives within an investment portfolio.

From a more targeted perspective, an equity asset allocation compares the mix of value vs. growth, US small-cap vs. US mid-cap vs. US high-cap, and US vs. international developed vs. emerging markets within an investment portfolio.

2. Considering Tax Allocation for Asset Allocation

Tax allocation considers the overall mix of taxable investments vs. pre-tax investments vs. tax-free investments within an investment portfolio.

Depending on one’s overall investment portfolio and tax allocation composition, it’s important to consider different asset allocations for taxable, pre-tax, and tax-free investments.

3. Passively Managed vs. Actively Managed vs. Target-Date

The Dell 401(k) offers investment options for passively managed, actively managed, and target-date funds.

Passively managed funds attempt to track the performance of indexes (ex. S&P 500) and generally have lower expense ratios.

Actively managed funds aim to outperform their benchmark (ex. S&P 500) by deciding what to buy and sell and generally have higher expense ratios.

Target-date funds attempt to target an asset allocation by considering one’s age and providing an asset allocation glide path that becomes more conservative as one approaches retirement. Target-date funds can be actively managed, passively managed, or somewhere in-between. Target-date fund expense ratios generally fluctuate in price depending on the fund’s holdings.

4. Expense Ratios

When considering the investment options in the Dell 401(k) plan, different funds may have different expense ratios. Low expense ratios reduce the overall cost of investing while high expense ratios diminish long-term returns.

5. Fund Performance

If tracking close to a benchmark, then a fund is likely an index fund. and its goal is not to beat the benchmark, but instead to track toward an index at a low cost.

If choosing actively managed funds, it’s critical to evaluate management style and to remember that past performance is no guarantee of future results. Also, performance is relative to the risk and return of the fund’s asset class.

Planning Opportunity for Dell’s 401(k)

Key Considerations

Dell offers an outstanding 401(k) plan. The Dell 401(k) plan includes a sizeable match, an ability to save beyond the elective deferral limit with after-tax contributions, an in-plan conversion option for after-tax contributions, and low-cost globally diversified investment options.

Unlike an IRA, a 401(k) allows individuals to make pre-tax and Roth contributions without concerns of being phased-out from high-income. Unlike Deferred Compensation, a 401(k) remains in your name and carries no bankruptcy risk. The 401(k) plan offers tax-efficient savings opportunities for retirement and a contribution limit significantly beyond the IRA limit.

Safe Landing Financial chooses investments that have low-costs, transparency, and help achieve a globally diversified portfolio across all investment accounts. Many Dell 401(k) investment options fit this criteria. It’s critical to align your investment strategy to your financial plan.

After-Tax 401(k) Is Not for Everyone; Considering the Mega-Backdoor Roth.

To avoid a future tax headache from making after-tax contributions, it is critical to convert funds from after-tax 401(k) to either Roth 401(k) or Roth IRA. Contributions are not taxed. If untreated, after-tax earnings are taxed as ordinary income when distributed from the plan if certain requirements are met. With the in-plan-Roth-conversion, earnings grow tax-free and are distributed tax-free if certain requirements are met.

Learn more about the Mega-Backdoor Roth at Dell.

Take the time to determine the right 401(k) contribution amount and investment options amount for your needs. Consulting with a fiduciary financial planner can help provide peace of mind for you and your family.

If you’re a Dell employee and have questions about the 401(k) plan, feel free to contact me at [email protected].

More Resources

Should I Contribute to My Roth 401(k) (Free PDF resource)

What Issues Should I Consider With My Employer-Provided Benefits? (Free PDF resource)

2025 Important Planning Numbers? (Free PDF resource)

Financial Planning for Dell Employees

Restricted Stock Units at Dell

Mega-Backdoor Roth 401(k) at Dell

HSA at Dell

Deferred Compensation Plan at Dell

Disability Insurance at Dell

Life Insurance at Dell

Mega-Backdoor Roth Guide

Backdoor Roth Guide

Deferred Compensation Guide + Case Study

HSA Guide + Strategy for Reimbursement

RSU Guide + Strategy After Vesting

Disclosure: Even though many of our clients are current and former Dell employees, Safe Landing Financial is not affiliated, associated, or endorsed by Dell. This information is supplied from sources that we believe to be reliable, however, we cannot guarantee the accuracy. All information is subject to change without notice. Please refer to your Dell benefits guide for up-to-date information.