Deferred Compensation at Dell

Participating in Dell’s Deferred Compensation Plan offers a tax-advantaged strategy for high-income executives to set aside additional funds for retirement, allowing them to benefit from tax-deferred growth and enhance their retirement planning beyond traditional limits.

Learn everything Dell employees need to know about their Deferred Compensation Plan.

How Dell’s Deferred Compensation Plan Works

Eligibility

Dell’s Deferred Compensation Plan (DCP) is accessible to eligible U.S.-based distinguished engineers, fellows, directors managing people, and executives.

Enrollment

Elections to participate in the DCP plan are only offered during the DCP annual enrollment period in late November/December. Deferral elections may not be changed once the enrollment period ends until the next DCP period. Deferral elections become irrevocable after the enrollment period ends and remain locked in place for the plan year.

Deferrals

The DCP allows for flexibility in choosing which compensation you would like to defer. You can make deferral elections of 1% to 85% for the following compensation types:

- Base Pay

- Commissions

- Performance Bonuses*

- All Other Eligible Bonuses

*Note: Dell pays performance bonuses in the subsequent year.

DCP Taxes

Deferrals into the DCP:

No federal, state, or local income taxes are withheld or paid at the time of deferral. However, deferred compensation is considered income for FICA taxes (Social Security up to the annual wage maximum and Medicare for all amounts).

Investing within the DCP:

There are no taxes on capital gains, dividends, or interest for investments within the DCP. Like an IRA or 401(k), investments grow tax-deferred until distribution.

Distributions out of the DCP:

DCP income is subject to federal, state, and local income tax upon distribution. No additional FICA taxes are due, as they were paid at the time of deferral.

DCP Provider

Dell’s DCP is on the Fidelity Net Benefits platform (Fidelity Investments).

DCP Distribution Options

The DCP offers flexibility in timing distributions. During each enrollment period, you can customize the payment timing and method for upcoming plan year deferrals and for each type of compensation you choose to defer.

Timing options

Receive distributions at the earlier of

- Separation from Dell

- A fixed date at least three years in the future

Method

Choose to receive distributions in one lump-sum payment or annual installments of two to 15 years.

Making Changes to Your Distribution Schedule

You may make changes to your distribution election by following these rules:

- Any change causes a minimum five-year delay after the initially scheduled distribution.

- Any changes must be made at least 12 months in advance of the first scheduled payment date of the deferral.

- The delay applies to the entire deferral.

- For example, to postpone a lump-sum distribution scheduled for January 1, 2027, then you must adjust your distribution election by December 31, 2025. The earliest date for receiving the distribution would then be January 1, 2032.

Circumstantial DCP Distribution Situations

The DCP provides distribution options for the following situations:

- Unforeseen emergency causing severe financial hardship

- Death

- Permanently Disability

DCP Risks

Before deciding to participate in the DCP, it is important to be aware of several risks, including:

- Once deferral elections are finalized, then you are essentially locked into the DCP.

- There is no assurance that taxes will be lower in future years.

- Investments within the DCP carry inherent risks, and there is no guarantee for favorable investment performance.

- There is a potential “tax bomb” upon separation from Dell.

- Your DCP account balance is subject to the claims of Dell’s creditors in the event of Dell’s insolvency.

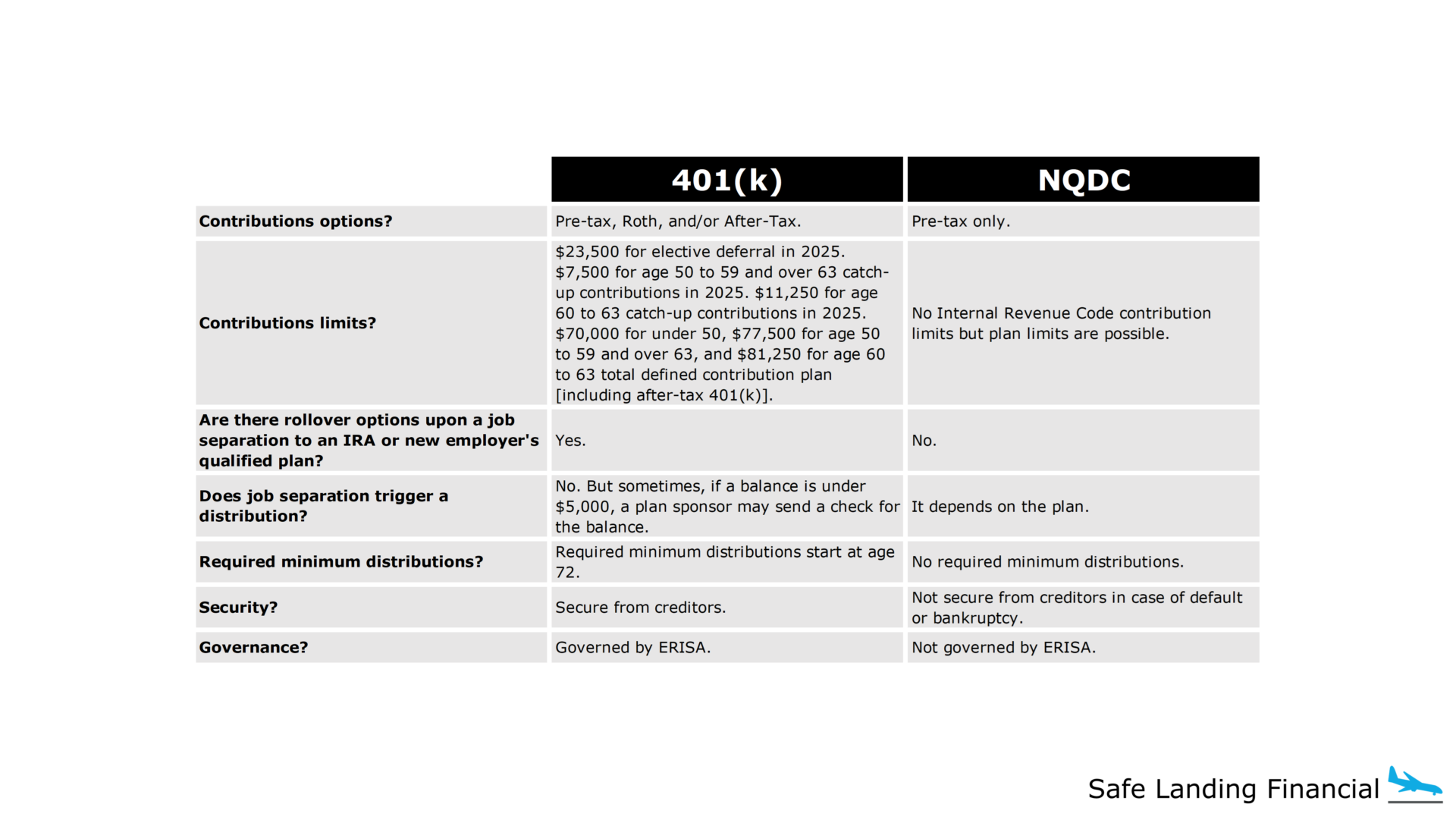

Dell’s DCP vs. 401(k)

Like the 401(k), Dell’s DCP offers investments for a variety of asset classes and strategies. The menu of investments includes passively managed funds, actively managed funds, and target-date funds.

Here are other key differences between Dell’s DCP and 401(k).

Planning Opportunity for Dell’s Deferred Compensation Plan

The DCP plan presents an enticing opportunity for high-earning Dell employees to strategically save for retirement while minimizing tax implications.

Participating in Dell’s DCP can make financial sense if:

- You are looking for additional retirement savings opportunities and already maxing out contributions for 401(k), HSA (if applicable), and IRA.

- You have sufficient funds available in other accounts to meet financial goals until separation from Dell.

- There is a current year tax benefit and future taxes are projected at lower rates.

- You are comfortable with the risk of potentially not receiving DCP funds.

- You are aware of tax planning considerations within your financial plan for separation from Dell.

It is important to recognize the significant risks involved, as deferred compensation may not make sense in every scenario. Understanding your unique financial situation can help determine how to best move forward.

Take the necessary time to assess if DCP is a good fit. Then, determine the appropriate DCP deferral amount and investment options for your needs. Consulting with a fiduciary financial planner can help provide peace of mind for you and your family.

If you’re a Dell employee and have questions about the DCP, feel free to contact me at [email protected].

More Resources

Deferred Compensation Guide + Case Study

What Issues Should I Consider With My Employer-Provided Benefits? (Free PDF)

Financial Planning for Dell Employees

Restricted Stock Units at Dell

401(k) Plan at Dell

Mega-Backdoor Roth 401(k) at Dell

Disability Insurance at Dell

Life Insurance at Dell

Mega-Backdoor Roth Guide

Backdoor Roth Guide

HSA Guide + Strategy for Reimbursement

RSU Guide + Strategy After Vesting

Disclosure: Even though many of our clients are current and former Dell employees, Safe Landing Financial is not affiliated, associated, or endorsed by Dell. This information is supplied from sources that we believe to be reliable, however, we cannot guarantee the accuracy. All information is subject to change without notice. Please refer to your Dell benefits guide for up-to-date information.