Health Savings Account at Dell

Learn everything Dell employees need to know about their HSA plan.

In 2003, health savings accounts (HSAs) were introduced to encourage individuals with high-deductible health plans to save for medical expenses by offering a triple-tax advantage.

Employees participating in Dell’s high-deductible health plan are eligible to contribute to an HSA.

HSA’s Triple-Tax Advantage

Tax-Deductible Contributions

Similar to a pre-tax 401(k), contributions to an HSA are tax-deductible.

Tax-Deferred Growth

HSA assets grow tax-free.

Tax-Free Distribution

HSA distributions used for qualified medical expenses are tax-free.

Qualified medical expenses encompass a range of options, including prescription medications, doctor visits, dentist visits, eyeglasses, long-term care insurance premiums, and Medicare premiums, among others.

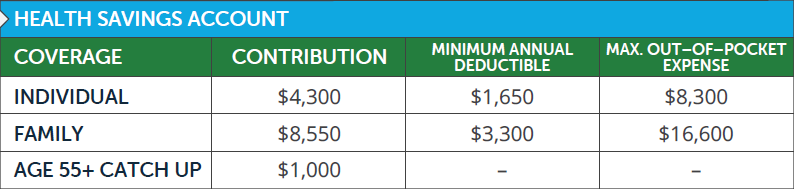

2025 HSA Contribution Limits

In 2025, an eligible individual can contribute $4,300 into an HSA. At age 55 or above, individuals can contribute an additional $1,000.

Eligible individuals can contribute $8,550 collectively to an HSA for family coverage.

Source: 2025 Important Planning Numbers

Dell’s HSA Plan

Dell employees must elect an HSA when enrolling in the high-deductible health plan. Whether you decide to contribute to your HSA or not, Dell provides $750 for “you only” coverage, and if you also cover dependents, the amount increases to $1,500. Dell’s HSA is offered through Alight Smart-Choice.

Similar to a 401(k) match, Dell’s contribution is not tax-deductible. Employees must factor Dell’s contribution when considering annual contribution limits.

After your Dell HSA reaches $1,000, then Alight Smart-Choice allows for you to invest the HSA with a menu of mutual funds.

Example of Dell’s Health Savings Account

Kelly (48) and her husband Eric (50) are enrolled in an HSA eligible high-deductible health plan.

Kelly contributes $7,050 throughout the year and receives an employer match of $1,500 to max-out her HSA. Kelly and Eric are in the 32% federal tax-bracket. By maxing out an HSA, not only do they save tax-efficiently for retirement, but they also save over $2,000 in taxes by reducing their taxable income.

Kelly chooses to invest her HSA for long-term growth once it’s over the $1,000 required minimum. Similar to an IRA or 401(k), investments within the HSA grow tax-deferred.

Because Kelly and Eric accrue qualified medical expenses and keep their receipts, they do not owe taxes down the road when they distribute HSA funds.

Planning Opportunity for Dell’s HSA

An HSA is Not For Everyone

While saving with an HSA can be a smart financial move for many, it’s important to note that it’s not for everyone. To contribute to an HSA, you must enroll in a high-deductible health plan. Dell employees facing complex healthcare needs, those who prefer traditional health plans, Medicare enrollees, large families frequently visiting the doctor, and others might find that high-deductible health plans are not a good fit.

Key HSA Considerations

- HSAs offer a triple-tax advantage (tax-deductible contributions, tax-deferred growth, and tax-free distributions for qualified medical expenses).

- Unused HSA funds roll over each year.

- The funds remain yours even when you part ways with Dell.

Leveraging HSA to Strategically Build Wealth

Alight Smart-Choice provides eligible Dell employees with an HSA debit card, but that doesn’t mean you should rush into using it. There’s no immediate deadline for reimbursing yourself for qualified medical expenses.

By opting to pay qualified medical expenses out of pocket and investing your HSA funds, you open the potential for tax-free compound growth for investments.

This strategy proves valuable for households possessing an adequate emergency fund and the means to pay for qualified medical expenses out of pocket.

To execute this strategy, staying organized and saving receipts for future reimbursement is essential.

Pro-tip: Keep receipts in a folder in the cloud. Consider maintaining an Excel file within the folder.

If you’re a Dell employee and have HSA questions, feel free to contact me at [email protected].

More Resources

Can I Make a Deductible Contribution to My HSA? (Free PDF resource)

Will the Distribution From My HSA be Tax & Penalty-Free? (Free PDF resource)

What Issues Should I Consider With My Employer-Provided Benefits? (Free PDF resource)

2025 Important Planning Numbers? (Free PDF resource)

Financial Planning for Dell Employees

Restricted Stock Units at Dell

401(k) at Dell

Mega-Backdoor Roth 401(k) at Dell

Disability Insurance at Dell

Life Insurance at Dell

Mega-Backdoor Roth Guide

Backdoor Roth Guide

Deferred Compensation Plan at Dell

Deferred Compensation Guide + Case Study

HSA Guide + Strategy for Reimbursement

RSU Guide + Strategy After Vesting

Lively Eligible expenses for HSA

Disclosure: Even though many of our clients are current and former Dell employees, Safe Landing Financial is not affiliated, associated, or endorsed by Dell. This information is supplied from sources that we believe to be reliable, however, we cannot guarantee the accuracy. All information is subject to change without notice. Please refer to your Dell benefits guide for up-to-date information.