Tax Planning

Tax Planning for the Present and During Retirement

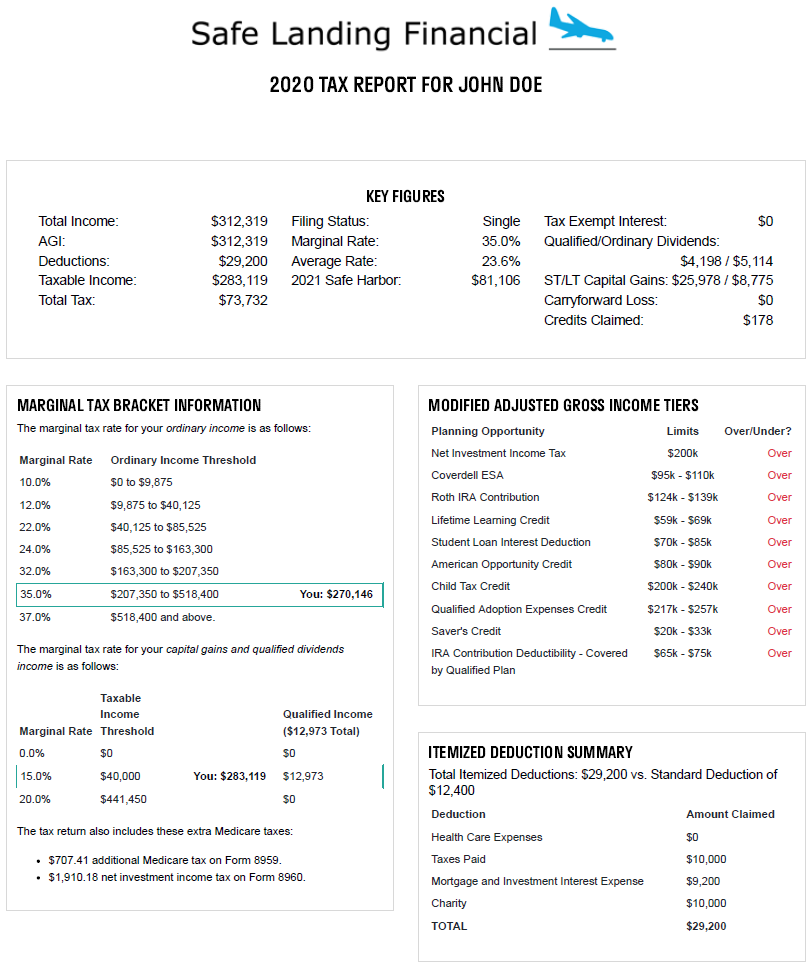

Safe Landing Financial’s tax planning focus is to minimize taxes in the present and during retirement. We accomplish this by evaluating:

- Where to put additional savings to maximize your finances (ex. HSA vs. Roth IRA vs. 401k vs. 529 plan vs. Trust account)

- Roth Analysis (Roth IRA contributions, Roth conversions, etc.)

- Cash-flow planning to better manage and minimize taxes (ex. Income, Social Security, pensions, required minimum distributions, tax-efficient retirement income distribution etc.)

- Investment strategies (ex. Long-term vs. short-term capital gains, tax-loss harvesting, asset location, etc.)

- Annual gifting strategies (ex. College planning, lessening estate planning burden, etc.)

- Charitable Giving Strategies (ex. Donor-advised funds, qualified charitable contributions, etc.)

Staying On Track

Tax laws change all the time and have significant implications. You might be paying more taxes if you’re not aware of these changes. How you earn, save, spend, and invest your money impacts your tax return. That’s why Safe Landing Financial uses advanced planning software to evaluate cash flows and minimize taxes.

We stay up-to-date with tax laws and can work directly with your CPA to help make your financial life run more smoothly.

More on Tax Planning for the Present and During Retirement

Using Mega-Backdoor Roth to Enhance Your Retirement

3 Things for Tech Professionals to Know About RSUs

Important Numbers for 2023 (printable PDF guide)

Health Savings Account Triple-Tax Advantage

Best Charitable Giving Strategy for Your Unique Situation

Kitces.com: Tax-Efficient Spending Strategies From Retirement Portfolios

Kiplinger: Paying Taxes Wisely: A Fresh Look at Tax-Efficient Withdrawal Strategies

Nerdwallet: How to Do a Roth IRA Conversion in 3 Steps

Fidelity: Asset Location

FREE FINANCIAL PLANNING CONSULTATION

A complimentary 4-step process sharing how to minimize

taxes, optimize investments, and enjoy retirement on your terms.

This process is designed to help you evaluate our services

and make an informed choice for planning your financial future.