Dell Mega-Backdoor Roth 401(k) in 2025

Learn how Dell’s mega-backdoor Roth strategy helps employees boost retirement savings beyond standard limits and enjoy tax-free growth. This powerful strategy allows after-tax contributions to grow tax-free, offering a significant advantage for long-term wealth accumulation.

In this guide, you’ll learn everything about Dell’s mega-backdoor Roth, including how it works, contribution limits, tax implications, and case studies to help you decide if it’s right for you.

How Dell’s Mega-Backdoor Roth Works

The mega-backdoor Roth is a strategy for saving more aggressively and tax-efficiently for retirement by making after-tax contributions to a 401(k) plan and then converting those contributions to a Roth IRA or Roth 401(k).

In 2025, individuals can contribute up to $23,500 in pre-tax or Roth 401(k) elective deferrals. Individuals age 50 to 59 or over 63 can make a catch-up contribution of $7,500. Individuals age 60 to 63 can make a catch-up contribution of $11,250.* Dell matches 6% of contributions, up to $7,500. Individuals are eligible to contribute an additional $39,000 in after-tax contributions to their 401(k).

In 2025, individuals under age 50 can make up to $70,000 in total 401(k) contributions. Individuals between the ages of 50 to 59 and over 63 can make up to $77,500 in total 401(k) contributions. Individuals between the ages of 60 and 63 can make up to $81,250 in total 401(k) contributions.

For Dell employees utilizing the mega-backdoor Roth strategy in 2025, the amount they can contribute as after-tax contributions is the difference between the total 401(k) contribution limit and the combined limits for elective deferrals, employer matching, and catch-up contributions.

To complete the mega-backdoor Roth and avoid a future tax headache, it is critical to convert funds from the after-tax 401(k) to either a Roth 401(k) or Roth IRA.

*Important Note: The age 60 to 63 catch-up contribution is a new rule for 2025. Please confirm the amount with your 401(k) plan administrator.

Tax Consequences from Participating in the Mega-Backdoor Roth

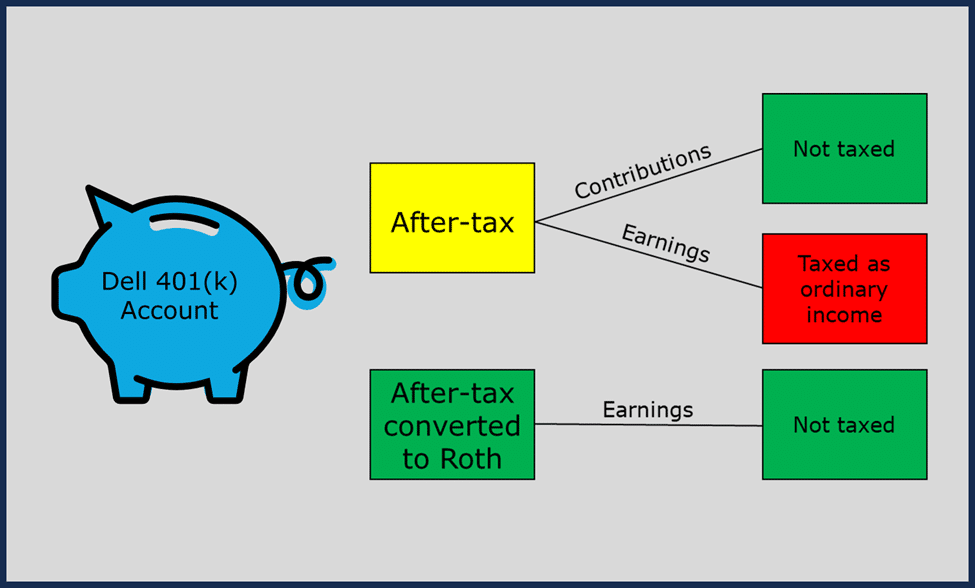

After-tax 401(k) contributions are not taxed when distributed. However, if left untreated, after-tax earnings are taxed as ordinary income when distributed from the 401(k).

So, why would anyone utilize after-tax contributions? After-tax 401(k) contributions grow tax-free after the funds are converted to a Roth IRA or Roth 401(k). Without a Roth conversion, there are generally more tax-efficient ways to save for retirement than by participating in an after-tax 401(k).

How to Execute the Mega-Backdoor Roth for Dell’s 401(k) Plan

Here are steps for executing the mega-backdoor Roth:

- Determine if the mega-backdoor Roth makes sense within your financial plan.

- Determine what percentage of your paycheck you want to allocate toward after-tax 401(k) contributions.

- Update the after-tax percentage online via Fidelity Net Benefits. Processing may take up to one or two pay cycles.

- Have a process in place for converting funds from after-tax 401(k) to Roth IRA or Roth 401(k).

To properly execute the mega-backdoor Roth, you need a process to move after-tax 401(k) funds to a Roth IRA or Roth 401(k). Here are three ways to accomplish this:

- Call the Fidelity Net Benefits desk to make automatic in-plan conversions from after-tax 401(k) to Roth 401(k).

- Call the Fidelity Net Benefits desk to convert funds from the after-tax 401(k) to a Roth IRA*.

- In some situations, there may be a toggle button when logging in to Fidelity Net Benefits that allows you to select automatic in-plan conversions from after-tax 401(k) to Roth 401(k).

*The after-tax 401(k) to Roth IRA process isn’t automatic and takes much more work to implement.

The phone number for the Fidelity Net Benefits Desk is 1-800-466-2900.

Mega-Backdoor Roth FAQs

When should I consider the mega-backdoor Roth?

The mega-backdoor Roth strategy is best for individuals who have maxed out their pre-tax or Roth 401(k) elective deferral and have additional funds to save tax-efficiently for retirement.

When should I not consider the mega-backdoor Roth?

If you’re not planning to maximize your 401(k) elective deferral or have other financial goals besides retirement that require more immediate attention, then the mega-backdoor Roth may not be appropriate.

Should I contribute to pre-tax or Roth instead of after-tax 401(k)?

In most situations, it is more beneficial to max out pre-tax or Roth contributions before considering after-tax contributions. Pre-tax and Roth 401(k) contributions receive a 6% match up to $7,500, while after-tax contributions receive $0.

Should I invest extra savings in a taxable brokerage account or after-tax 401(k)?

It depends. It’s valuable to have taxable funds for short-term and mid-term goals. Meanwhile, after-tax 401(k) is one of the better tax-advantaged savings options when planning for retirement. Depending on your goals and time horizon, some may find more value by saving in a taxable brokerage account, while others may find more value in saving in the after-tax 401(k).

Should I invest extra savings into Dell’s deferred compensation plan or after-tax 401(k)?

It depends.

It’s unlikely that one would choose to participate in the deferred compensation plan instead of the mega-backdoor Roth strategy. In fact, one could argue for the importance of maxing out many other tax-advantaged accounts before focusing on deferred compensation.

It’s more likely that one would choose to contribute to deferred compensation after it’s clear that they will max out the 401(k). Additionally, to add to the complexity, deferred compensation participation must be selected by December of the previous year, while after-tax 401(k) participation can be toggled on-demand throughout the year.

Deferred compensation can be valuable for minimizing taxes during high income years, but the risks are significant compared to other investment accounts.

Planning Opportunity for Dell Mega-Backdoor Roth 401(k) in 2025

Most companies do not offer the mega-backdoor Roth strategy. Without a doubt, the mega-backdoor Roth is one of the most valuable benefits for high-income Dell employees. The mega-backdoor Roth provides a lucrative opportunity for Dell employees seeking to enhance tax-free retirement savings. However, it’s important to acknowledge that it’s not for everybody!

Here are some pros and cons for using the Dell mega-backdoor Roth:

Pros

- The mega-backdoor Roth creates a tax-free savings opportunity of up to $39,000 for 2025.

- Investments grow tax-deferred.

- Funds can later be distributed tax-free during retirement.

Cons

- The mega-backdoor Roth is for long-term savings that are not easily accessible until retirement. Should you need funds sooner, then other account types may offer better accessibility.

- Pre-tax and Roth 401(k) contributions receive an employer match, but after-tax savings do not.

- Missing a step while attempting to complete this advanced planning strategy may unknowingly create a major tax headache for future you.

Take the time to determine if the mega-backdoor Roth is right for your unique financial situation. Consulting with a fiduciary financial planner can help provide peace of mind for you and your family.

If you’re a Dell employee and have questions about after-tax 401(k) savings or the mega-backdoor Roth strategy, feel free to contact me at [email protected].

More Resources

Can I Make a Mega-Backdoor Roth Contribution? (Free PDF)

What Issues Should I Consider With My Employer-Provided Benefits? (Free PDF)

Financial Planning for Dell Employees

Restricted Stock Units at Dell

401(k) Plan at Dell

Deferred Compensation Plan at Dell

Disability Insurance at Dell

Life Insurance at Dell

Mega-Backdoor Roth Guide

Backdoor Roth Guide

Deferred Compensation Guide + Case Study

HSA Guide + Strategy for Reimbursement

RSU Guide + Strategy After Vesting

Disclosure: Even though many of our clients are current and former Dell employees, Safe Landing Financial is not affiliated, associated, or endorsed by Dell. This information is supplied from sources that we believe to be reliable, however, we cannot guarantee the accuracy. All information is subject to change without notice. Please refer to your Dell benefits guide for up-to-date information.