5 Things You Need to Know About Fee-Only Financial Advisors

A fee-only financial advisor earns transparent compensation directly from clients, offers unbiased advice, and limits conflicts of interest.

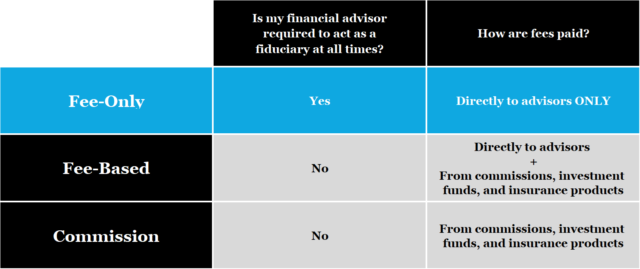

What are the different types of financial advisors?

A financial advisors is compensated in one of three different ways: fee-only, fee-based, or commission.

Fee-Only

Some financial advisors are fee-only. A fee-only financial advisor earns a flat fee, hourly rate, or a percentage of assets under management directly from their clients.

Fee-Based

Some financial advisors are fee-based. A fee-based financial advisor gets paid a commission when investment vehicles are bought and sold and may also earn a flat fee, hourly rate, or a percentage of assets under management.

Commission

Some financial advisors earn commissions only. A commission-based financial advisor gets paid a commission when investment vehicles are bought and sold.

Comparing Different Types of Financial Advisors

How do I know if my financial advisor is acting in my best interest?

A commission or fee-based financial advisor receives compensation based on specific financial products bought and sold. Because of these conflicts of interest, financial advisors under these models may not always put a client’s interests above their own. It’s especially confusing for investors with fee-based advisors. Fee-based advisors may be required to serve as a fiduciary but only part of the time!

A fee-only financial advisor must act in their clients’ best interest. There is fewer inherent conflicts of interest because they are not compensated based on product sales or referrals. Instead, they are compensated directly from their clients.

Why should I work with a fee-only financial advisor?

A fee-only financial advisor offers unbiased advice, transparency in costs and financial advice provided, and comprehensive financial planning.

Unbiased advice

A fee-only financial advisor serves as a fiduciary and must act in your best interest at all times. A fiduciary is required to disclose if and when there is a potential conflict of interest.

A commission-only or fee-based financial advisor is not required to serve as a fiduciary at all times. A fee-based advisor might recommend products or services to you in part because of the commission they might earn, rather than based on how well it fits into your investment strategy.

Comprehensive Financial Planning

A fee-only financial advisor can create a comprehensive financial plan focusing on financial planning, retirement planning, investments, Social Security optimization, tax planning, insurance planning, estate planning, and more.

Consider working with a CERTIFIED FINANCIAL PLANNER™ to find a credentialed financial advisor. Beware of a financial advisor that tries selling products without understanding your unique financial situation.

If you require a specific need or style of financial advice, for example a high-earning household preferring to limit taxes during high-income years, make sure your financial advisor can satisfy your needs and help reach financial goals.

Transparency in costs and financial advice provided

“Price is what you pay. Value is what you get.” -Warren Buffett

Beware of selecting a financial advisor based only on cost. There are high-cost and low-cost options for financial advice. While cost should be a consideration, consider the value of the financial advice towards your unique situation.

A benefit of working with a fee-only financial advisor is having transparency and predictability in costs for advice provided.

A commission-only and fee-based financial advisor may may have additional conflicts of interest with incentives to buy and sell financial products that are not in your best interest. A complicated fee structure should serve as a red flag.

What are some good questions to ask a financial advisor?

Are you a fiduciary at all times?

How do you earn compensation?

Do you have a clean regulatory background?

What education and certification qualifications do you have?

Is financial advice provided for investments only, financial planning only, or both investments and financial planning?

How comprehensive is your financial advice and what areas will we focus on?

What is your approach to financial planning and/or investments?

How do you determine my investment and rebalancing strategy?

Will you help to implement your provided financial advice?

Will I work directly with you?

How do we get started and how often will we meet?

How can I find a fee-only financial advisor?

Here are a few resources to confirm you are working with a fee-only financial advisor.

The National Association of Personal Financial Advisors

“The National Association of Personal Financial Advisors (NAPFA) is the country’s leading professional association of Fee-Only financial advisors—highly trained professionals who are committed to working in the best interests of those they serve.”

– The National Association of Personal Financial Advisors

Fee-Only Network

“The only financial advisor who can truly provide unbiased and objective financial advice, financial planning and investment management is an independent financial advisor (Registered Investment Advisor) operating under a strict fee-only compensation model, as defined by the National Association of Personal Financial Advisors (NAPFA).”

– Fee-Only Network

XY Planning Network

“The XY Planning Network is the leading organization of fee-only financial advisors who are focused on working with Generation X and Generation Y clients. Our mission is to connect consumers with best-in-class financial advisors who specialize in working with clients just like you.”

– XY Planning Network

More Resources

Mega-Backdoor Roth Guide + Flowchart

RSU Guide + Strategy After Vesting

Backdoor Roth Guide + Flowchart

HSA Guide for Triple-Tax Advantage

Deferred Compensation Guide

Kitces.com: The 4 Different Types Of Fiduciary Financial Advisors

XYPN: Why Should I Hire a Fee-Only Financial Advisor?

Fee-Only Network: Fee-Only vs. Fee-Based Advisor Compensation

NAPFA: Consumer Resources

Fee-Only Financial Advisor for Tech Professionals