Market Timing – Avoid It!

As an Austin, TX financial planner, an investment management concept I always hear about is trying to time and beat the market. When it comes to investment performance, time in the market is better than timing the market.

Considered one of the best investors of all time, Warren Buffett has strong opinions on market timing. Buffett states, “I have never known anyone who could consistently time the market. And in fact I’ve never known anyone who knows anyone, who was able to consistently time the market.”

7. Avoid Market Timing

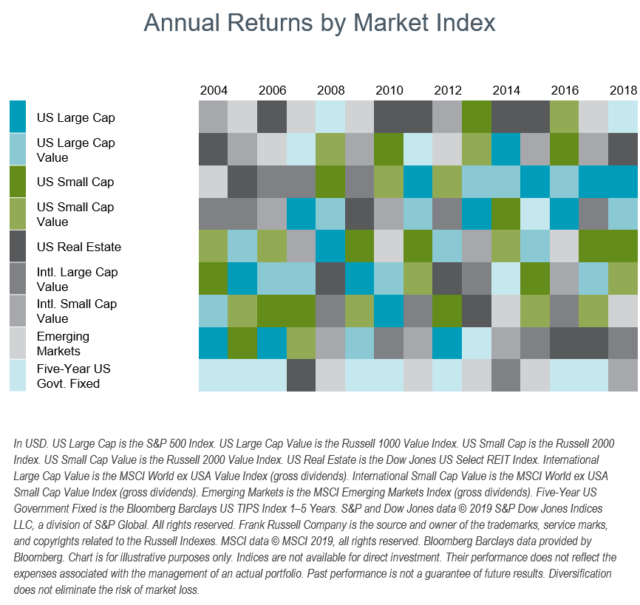

You never know which market segments will outperform from year to year. By holding a globally diversified portfolio, investors are well positioned to seek returns wherever they occur independent of time.

Even with a globally diversified portfolio, market movements can tempt investors to switch asset classes based on fear and greed with the hope to time the market.

This exhibit above features annual ranked performance of major asset classes in the US and international markets over the past 15 years. The asset classes are represented by corresponding market indices. The patchwork dispersion of colors shows that the relative performance of asset classes is unpredictable across time periods.

Investors who follow a structured, diversified approach are well positioned to seek returns whenever and wherever they occur. Diversification also reduces the risk of being heavily invested in an underperforming asset group in any given period of time.

This is part seven of a ten part series in pursuing a better investment experience.

Part One: Embrace Market Pricing

Part Two: Outguessing the Market – Don’t Try It!

Part Three: Past Performance – Don’t Chase It!

Part Four: Let Markets Work for You

Part Five: Consider the Drivers of Expected Returns

Part Six: Practice Smart Diversification

Part Eight: Separate Emotions From Investing

Part Nine: Look Beyond Investment Headlines

Part Ten: Control Your Investment Focus

For More:

Learn more about investment management services

What is a fiduciary financial advisor?

A Wealth of Common Sense: What if You Only Invested at Market Peaks?

Austin, TX Financial Planner

Still have questions in how to pursue a better financial planning and investment experience and avoid market timing? Meet with an Austin, TX financial planner.

by Brian Fry CFP®

Safe Landing Financial is a Los Angeles, CA fee-only financial advisor providing financial planning, retirement planning and investment management to tech professionals and pre-retirees. When you work with Safe Landing Financial, you work with Brian Fry, a fiduciary and CERTIFIED FINANCIAL PLANNER™ that puts clients’ best interests first. Financial planning services include: retirement planning, charitable giving, asset protection, estate planning, saving for college, debt management, tax strategy and investment management. Safe Landing Financial serves as a virtual fee-only financial advisor to individuals and families nationwide.