Separate Emotions From Investing

When google searching “best investment advice”, it’s important to understand that no financial advisor in Austin, TX or elsewhere in the US has a crystal ball for how the market will perform. Suze Orman, Dave Ramsey, Jim Cramer and other CNBC “experts” haven’t proven the ability to predict market events either.

8. Separate Emotions From Investing

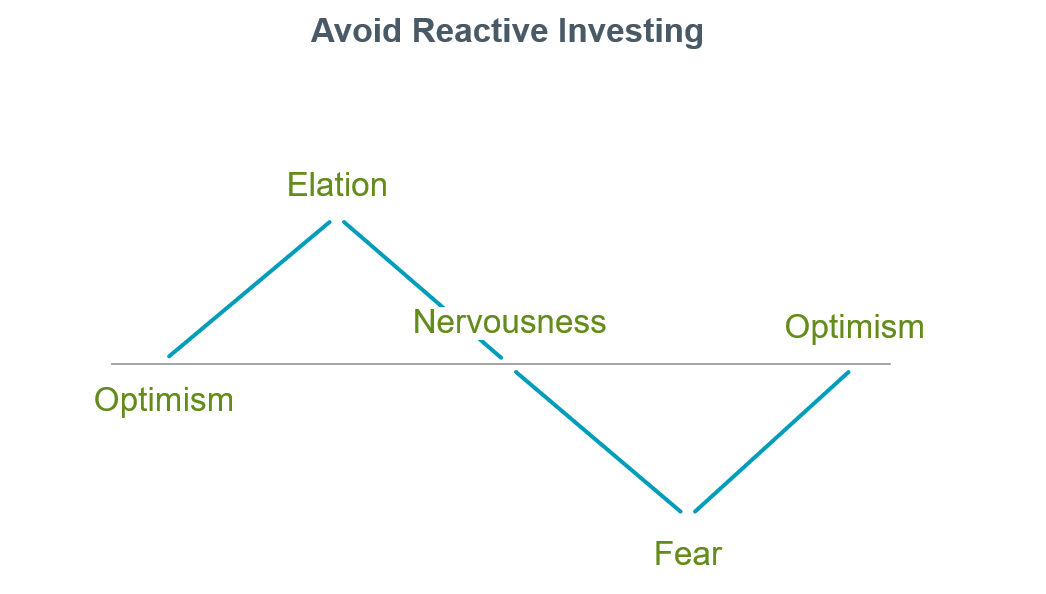

Many people struggle to separate their emotions from investing. Markets go up and down. Reacting to current market conditions may lead to making poor investment decisions.

While most investors hope to buy low and sell high, the 2008–2009 global market downturn offers an example of how the cycle of fear and greed can drive an investor’s reactive decisions. Some investors fled the market in early 2009, just before the rebound began. They locked in their losses and then experienced the stress of watching the markets climb.

Unfortunately, buying low and selling high is much harder than it sounds. I know investors that were still sitting on the sidelines waiting for a market crash or correction to get back into investing nearly a decade later. Investors tend to be their own worst enemy when experiencing investment losses.

Staying disciplined through rising and falling markets can pose a challenge, but it is crucial for long-term success. Working with a fee-only financial planner can help you stay focused on your long-term financial goals and offer investment advice guiding you through market turbulence.

This is part eight of a ten part series in pursuing a better investment experience.

Part One: Embrace Market Pricing

Part Two: Outguessing the Market – Don’t Try It!

Part Three: Past Performance – Don’t Chase It!

Part Four: Let Markets Work for You

Part Five: Consider the Drivers of Expected Returns

Part Six: Practice Smart Diversification

Part Seven: Market Timing – Avoid It!

Part Nine: Look Beyond Investment Headlines

Part Ten: Control Your Investment Focus

For More Information:

Learn more about investment management services

What is a fiduciary financial advisor?

Investopedia: How to Avoid Emotional Investing

Austin, TX Investment Advice

Still have questions in how to pursue a better financial planning and investment experience? Meet with a fee-only financial planner regarding investment advice in Austin, TX or virtually online.

by Brian Fry CFP®

Safe Landing Financial is a Los Angeles, CA fee-only financial advisor providing financial planning, retirement planning and investment management to tech professionals and pre-retirees. When you work with Safe Landing Financial, you work with Brian Fry, a fiduciary and CERTIFIED FINANCIAL PLANNER™ that puts clients’ best interests first. Financial planning services include: retirement planning, charitable giving, asset protection, estate planning, saving for college, debt management, tax strategy and investment management. Safe Landing Financial serves as a virtual fee-only financial advisor to individuals and families nationwide.