Past Performance – Don’t Chase It!

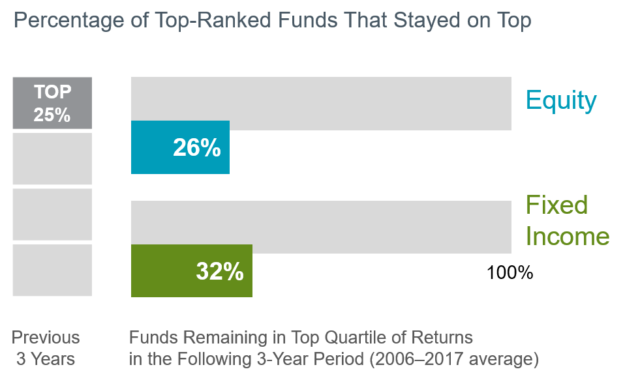

Past investment performance is no guarantee of future results. While often ignored, this is especially true for investors when choosing mutual funds. As an investment advisor in Los Angeles, I’ve seen some investors select mutual funds based on their past returns. Yet, past performance offers little insight into a fund’s future returns. For example, most funds in the top quartile (25%) of previous three-year returns did not maintain a top‐quartile ranking in the following three years.

3. Past Performance – Don’t Chase It!

Some investors may resort to using track records as a guide to selecting funds, reasoning that a manager’s past success is likely to continue in the future. Does this assumption pay off? The research offers strong evidence to the contrary.

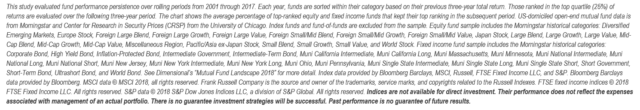

This exhibit shows that among equity funds ranked in the top quartile (25%) based on previous three-year returns, a minority also ranked in the top quartile of returns in the following three-year period.

A lack of persistence casts further doubt on the ability of managers to consistently gain an informational advantage on the market. Some fund managers might be better than others, but track records alone may not provide enough insight to identify management skill. Stock and bond returns contain a lot of noise, and impressive track records may result from good luck. The assumption that strong past performance will continue often proves faulty, leaving many investors disappointed.

This is part three of a ten part series in pursuing a better investment experience.

Part One: Embrace Market Pricing

Part Two: Outguessing the Market – Don’t Try It!

Part Four: Let Markets Work for You

Part Five: Consider the Drivers of Expected Returns

Part Six: Practice Smart Diversification

Part Seven: Marketing Timing – Avoid It!

Part Eight: Separate Emotions From Investing

Part Nine: Look Beyond Investment Headlines

Part Ten: Control Your Investment Focus

For More:

Learn more about investment management services

What is a fiduciary financial advisor?

US News: Don’t Fall Into the Past-Performance Trap

Fee Only Investment Advisor In Los Angeles

How do you consider past investment performance when pursuing a better financial planning and investment experience? Meet with a fee-only investment advisor in Los Angeles or online.

by Brian Fry CFP®

Safe Landing Financial is a Los Angeles, CA fee-only financial advisor providing financial planning, retirement planning and investment management to tech professionals and pre-retirees. When you work with Safe Landing Financial, you work with Brian Fry, a fiduciary and CERTIFIED FINANCIAL PLANNER™ that puts clients’ best interests first. Financial planning services include: retirement planning, charitable giving, asset protection, estate planning, saving for college, debt management, tax strategy and investment management. Safe Landing Financial serves as a virtual fee-only financial advisor to individuals and families nationwide.