Let Markets Work for You

When serving clients virtually as a fiduciary financial advisor or in-person in Austin, TX, I am asked how volatility impacts their portfolio. While volatility may be back in the markets, my answer remains the same: play the long game!

The financial markets have rewarded long-term investors. People expect a positive return on the capital they supply, and historically, the equity and bond markets have provided growth of wealth that has more than offset inflation.

4. Let Markets Work for You

Most people look to the financial markets as their main investment avenue—and the good news is that the capital markets have rewarded long-term investors. The markets represent capitalism at work in the economy—and historically, free markets have provided a long-term return that has offset inflation.

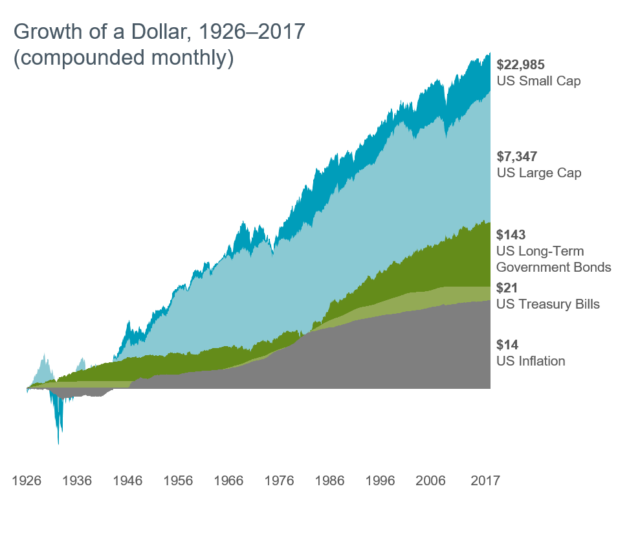

This is documented in the growth of wealth graph, which shows monthly performance of various indices and inflation since 1926. These indices represent different areas of the US financial markets, such as stocks and bonds. The data illustrates the beneficial role of stocks in creating real wealth over time. T-bills have barely covered inflation, while longer-term bonds have provided higher returns over inflation. US stock returns have far exceeded inflation and significantly outperformed bonds.

Another key point is that not all stocks or bonds are the same. For example, consider the performance of US small cap stocks vs. US large cap stocks over this time period. A dollar invested in small cap stocks in 1926 would be worth considerably more today than a dollar invested in large cap stocks.

Keep in mind that there’s risk and uncertainty in the markets. Historical results may not be repeated in the future. Nevertheless, the market is constantly pricing securities to reflect a positive expected return going forward. Otherwise, people would not invest their capital. In conclusion, when considering how volatility impacts your portfolio, consider your investment objective and risk tolerance.

This is part four of a ten part series in pursuing a better investment experience.

Part One: Embrace Market Pricing

Part Two: Outguessing the Market – Don’t Try It!

Part Three: Past Performance – Don’t Chase It!

Part Five: Consider the Drivers of Expected Returns

Part Six: Practice Smart Diversification

Part Seven: Marketing Timing – Avoid It!

Part Eight: Separate Emotions From Investing

Part Nine: Look Beyond Investment Headlines

Part Ten: Control Your Investment Focus

For More:

Learn more about investment management services

What is a fiduciary financial advisor?

Investopedia: Benefits of Holding Stocks for the Long Term

Virtual Fiduciary and Financial Advisor

Still have questions in how to pursue a better financial planning and investment experience? Meet with a fee-only fiduciary financial advisor in Austin, TX or on a virtual basis online.

by Brian Fry CFP®

Safe Landing Financial is a Los Angeles, CA fee-only financial advisor providing financial planning, retirement planning and investment management to tech professionals and pre-retirees. When you work with Safe Landing Financial, you work with Brian Fry, a fiduciary and CERTIFIED FINANCIAL PLANNER™ that puts clients’ best interests first. Financial planning services include: retirement planning, charitable giving, asset protection, estate planning, saving for college, debt management, tax strategy and investment management.Safe Landing Financial serves as a virtual fee-only financial advisor to individuals and families nationwide.